It is finally the holiday season. Everyone wants their fair share of gifts and treats, so much that all are also digging in their wallets and estimating the right amount that will fit with their shopping lists. While many stores offer promos and countless discounts, it would be safe to say that a critical part of managing ones budget isn’t just the price, but rather the amount of items to be given.

With that in mind, people are looking for a great bargain when it comes to shopping for gifts, a bargain that would enable them to purchase items multiple times and for a great value. You may ask then, what items would be fitting for my limited budget and where may I find them? Worry no more, as we had listed 20 stunning Christmas presents under 100 Pesos that you may give your loved ones, family, and friends:

1. Cellphone Holders

These items are one of the most affordable. Coming in at P19 apiece, they come in a variety of sizes (fit for any type of cellphone) and colors, truly a preppy gift for your friends.

2. Flower Pattern Nail Files

A gift for friends who are stylish and always on the go for grooming, these nail files are small enough to be kept in their purses and colorful enough to flaunt. They are also affordable, coming in at a price of only P66 at four files per set.

3. Hand Bookmarks

Usually found in bookstores, these P85 colorful hand bookmarks are just the right gift for bookworms, so much that they even have the term “bookworm” etched on them. How cool is that?

4. Lip Gloss

This is one item which may be found in your local drugstores. Only being priced at P89, they come in a variety of colors and flavors.

5. Foldable Nylon Bags

Remember the movie Inception? These types of bags are similar to that, in the sense that they are a bag within a bag. This item is usually represented in stalls as a small bag. Unzip that bag and take out the folded big brother (or sister) version of that bag. This is a perfect gift for your friends who are always on the go and may be purchased for only P85.

6. Desk Calendar

Since it’s the holiday season, why not remind your friends of that vacation you have been planning for a long time. Give them a desk calendar as a present and they will never forget any other date, ever again. These may be found and purchased at bookstores for only P50-P98.

7. Keychains

One of the most basic, yet, special gift you may give during the holidays. Keychains are the most appropriate ones to give for those who own four wheelers. They also come in many forms and colors, whatever design that you think would give your friends or family a good laugh. Animal faces would be a great suggestion. Usually, they are only sold for P30-P65.

8. Marker Stampers

They are basically markers, but instead of a felt tip, the end is usually composed of patterns, usually a flower, a fruit or an animal. They come in 6 sets and may be found in bookstores or art supplies, with a price of P95.

9. Baby Cologne

A certain clothing apparel has its own line of mini-bottled cologne. They come in various scents and are only priced at P39 each.

10. Nail Polish

Another gift for your stylish friends, this is one will brighten up their mood, especially if you choose to give them the glittered variety. This can be bought in beauty care shops and are usually priced at P95 per bottle.

11. Plastic Pouches

What good is a nail polish and a nail file if you can’t even store them properly in your purse? No worries, as plastic pouches are here to seal the deal. They can be bought in beauty care shops and are usually priced at P75 per piece.

12. Food-Shaped Erasers

A great gift for your smaller siblings, these are affordable at a price of P39. They come in shapes of burgers, cup noodles, etc. As with other school supplies, they may be bought from bookstores.

13. Fashion Shoelaces

Have a friend who’s passionate about his/her sneakers? Why not buy them fashion shoelaces. These come in variations of colors and are affordable at a price of P85. They’re sold at an apparel shop, from a certain mall up north.

14. Handkerchief

This is another affordable gift to give a family member or a loved one. Some stalls even enable you to customize the handkerchief with a name. A little extra charge is involved though, but still it’ll impress them of the creativity and dedication. Usually, this is sold around local stalls, selling at around P50, additional P15 for the name stitch-on.

15. Bottle Opener

For drinking buddies on weekends, a bottle opener would be a perfect gift. Some come in creative patterns and are sold at around P80-P95.

16. Patterned Paper Clips

Another great gift for your younger female siblings or friends, patterned paper clips adds style both in school and at the office. This may be found at bookstores and may be bought for a price of P65 per set.

17. Coin Bank

Inspire a friend to save up for your vacation next year with a coin bank. Usually coming in a variety of colors, they may be bought in P88 and P66 stores.

18. Pocket Journal

No need to collect coffee shop stars just for this item. Pocket journals are easy to find in bookstores and are priced at only P70. Some even come with calendar pages in them. Now that’s a neat gift.

19. Keyboard Brush

A great gift for your tech-savvy friends, keyboard brushes are a must-have for those sitting on the front of a monitor for a whole day. Believe us; they’ll thank you for it. These are usually sold at computer hardware stores and come in at price of P60.

20. Fridge Magnets

It’s one thing to decorate your kitchen, another to liven it up with a color. Fridge magnets are an old staple of any kitchen around the world, which is why manufacturers are stepping up their game in designing more innovative ones. Coming in various forms and sizes, they are usually sold at a price of P50-P70.

So aside from the very affordable items we had listed down, you may want to send your loved ones in the provinces a little assistance so that they may have a merry meal during their Christmas Eve dinner as well. After all, the Yuletide season is a time of giving and sharing, and indeed, everyone loves a cheerful giver. With that in mind, you may want to go for a remittance service that would enable your relatives to receive the amount in no time, and no hassle along the process.

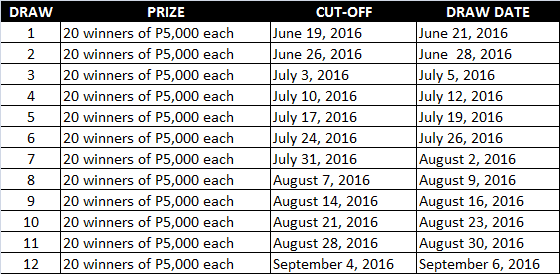

No need to look further, as Cebuana Lhuillier offers their Pera Padala Service, an easy, quick, and safe way to send and receive money. With more than 1,800 branches nationwide and accredited international partners, this money transfer service is made available to clients within and outside the Philippines. All transactions are real time, which enables clients to claim the money as soon as the sender completes the sending process in the branch. So what are you waiting for? Visit your nearest Cebuana Lhuillier branch now – we assure a fast, easy and secure transaction.

Image Source:

http://www.bestphonegrip.com/

http://nightowlpapergoods.com/index.php?route=2017-critter-desk-calendar

http://www.weiku.com/products/3419618/New_style_Spout_Pouch_wztxyy_z58_.html

https://www.aliexpress.com/popular/patterned-binder-clips.html

https://www.pinterest.com/pin/475552041872345879/

2. Never send money to unfamiliar people.

2. Never send money to unfamiliar people.