Pawning

In times of need, Cebuana Lhuillier is here for you, Ka-Cebuana!

With up to 30% higher appraisal rate vs. other pawnshops and 3,500 branches, we ensure that every Filipino has access to quick cash.

We accept a variety of pawn collateral, such as gold jewelry, diamonds, cellphones, watches, appliances, and much more!

Charges and Appraisal Rate

Cebuana Lhuillier assures highest appraisal and security for pawned items. Advance interest will be charged four pesos (Php4 ) for every Php100 loan amount. To maintain the excellent standard of service offered by Cebuana Lhuillier, clients will be charged additional one percent (1%) of the principal loan, but not exceeding five pesos (Php5). No other hidden charges will be deducted from the loan.

Cebuana Lhuillier Pawnshop offers a minimum of 90 days upon maturity and a maximum of 4 months on repayment of loan.

Our interest rate for renewed transactions begins at 4% plus 2% liquidated damages and a Php5 service charge.

SAMPLE COMPUTATION

RENEWAL

LOAN AMOUNT: Php10,000

RENEWAL DATE: 4TH MONTH

| DESCRIPTION | AMOUNT |

|---|---|

| Loan Value | Php10,000 |

| Interest Rate | Php2,200 |

| Service Charge | Php5 |

| Mailing Fee | Php10 |

| Total Renewal Amount | Php2,215 |

REDEMPTION

LOAN AMOUNT: Php10,000

REDEMPTION DATE: 4TH MONTH

| DESCRIPTION | AMOUNT |

|---|---|

| Loan Value | Php10,000 |

| Interest Rate | Php1,800 |

| Service Charge | N/A |

| Mailing Fee | Php10 |

| Total Redemption Amount | Php11,810 |

UP TO 30% HIGHER APPRAISAL RATE, WIDE NETWORK OF 3,500 BRANCHES AND VARIOUS DIGITAL TOUCHPOINTS

Branch

Cebuana Xpress

Cebuana From Home Website

SMS

Messenger

How to Pawn in

Cebuana Lhuillier Branch

1. Visit any Cebuana Lhuillier pawnshop branch and present the item you wish to pawn

Other Items Accepted:

- Musical instruments

- Medical equipment

- Power tools

- Mechanical tools

- Motorcycle accessories & riding gears

- Portable GenSet

- Expensive toys (drones, sports cam, robotics)

- Appliances

- Kitchenware

- Bicycle

- Apparels (bags, shoes)

2. Fill out the prenda card with your basic information.

3. The branch personnel will give you the appraised value.

4. Inform the branch personnel whether you accept the appraised value, or if you would like to negotiate for a lower take-home amount.

5. Sign the pawn ticket in the space provided.

HOW TO RENEW IN

CEBUANA LHUILLIER BRANCH

With Cebuana Lhuillier’s Renew Anywhere option, there is no need to go back to the branch where the item was pawned to renew the loan. Simply visit any Cebuana Lhuillier branch and follow the steps below:

- At the back of the pawn ticket, sign on the space along the ‘Received by’

- Present the pawn ticket and the payment for the amount due.

- Sign on the space provided on the electronic validation at the back of the pawn ticket.

- Sign new pawn ticket on the space provided.

- Secure the new pawn ticket, which is required to be presented during renewal or redemption of the pawned item.

HOW TO REDEEM IN

CEBUANA LHUILLER BRANCH

- Visit the Cebuana Lhuillier Pawnshop branch where the item is pawned.

- At the back of the pawn ticket, sign on the space along the ‘Received by’ note and below the ‘Received the article(s) in the same condition when pawned and redeemed’.

- Present the pawn ticket and the payment for the amount due.

- Sign on the space provided on the electronic validation at the back of the pawn ticket.

- Open the sealed plastic pouch to check the item.

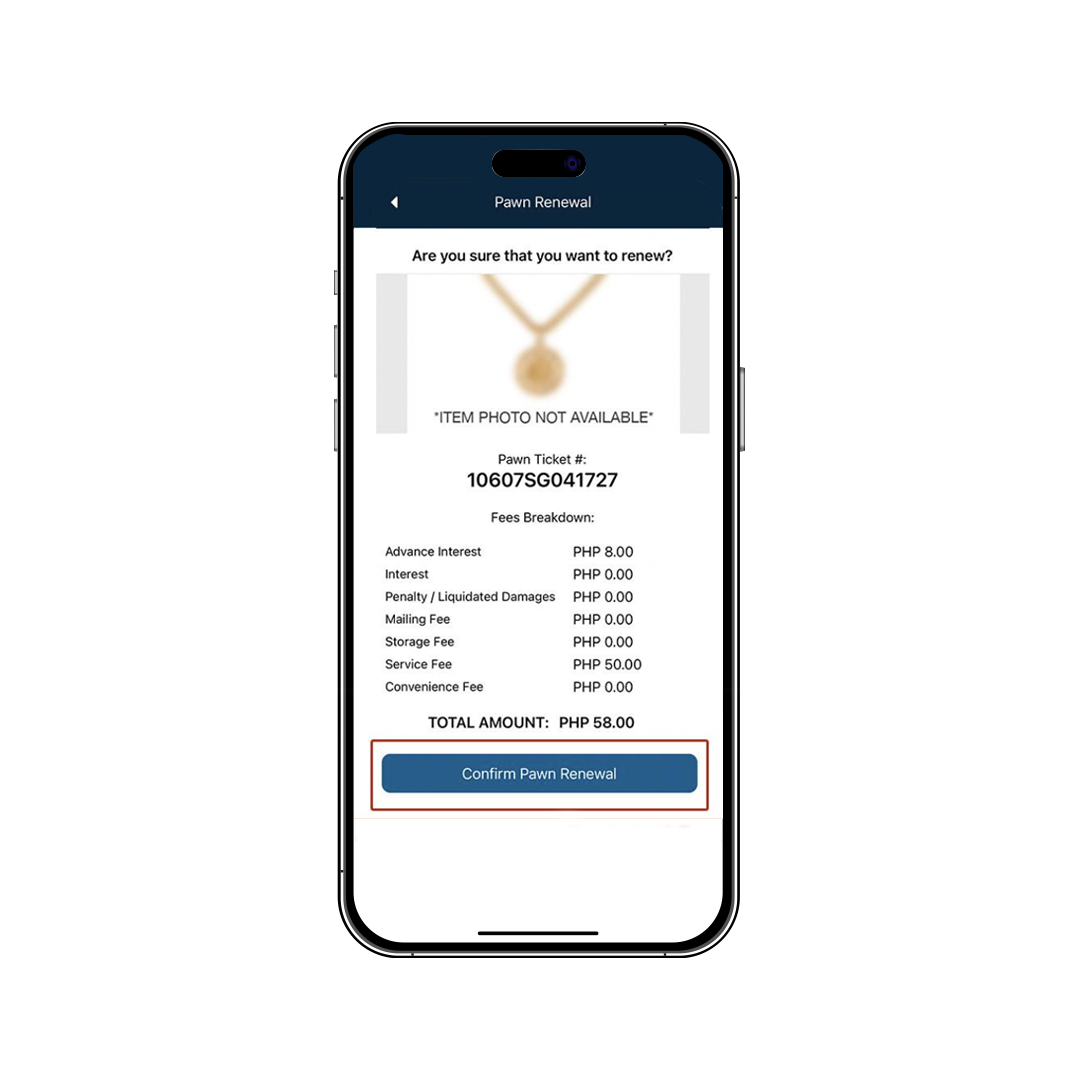

How to RENEW using

Cebuana Express Mobile App

- Log in to your Cebuana Xpress account and click ‘Pawning’

- Select the specific pawn ticket then click ‘Renew’

- The total amount to be settled will appear. Click ‘Confirm Pawn Renewal’ to proceed.

- Enter the OTP sent to your registered mobile number.

- A confirmation screen with your new Pawn Ticket Number is displayed after every successful transaction.

Reminder: If the day of your renewal on the app is earlier than your original due date, the day of your renewal transaction on the app will be your new renewal due date.

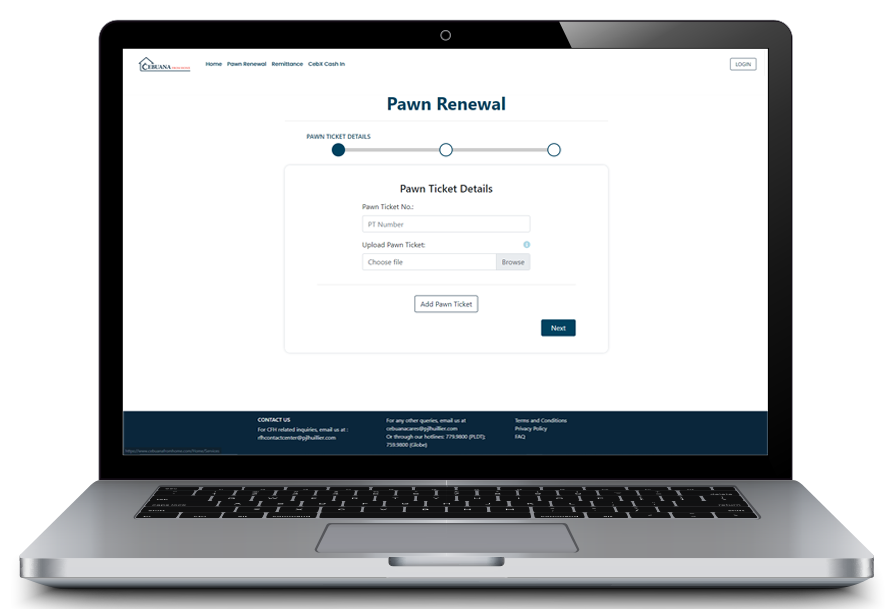

HOW TO RENEW ON

CEBUANA FROM HOME

- Visit www.cebuanafromhome.com and click ‘Mag Renew’’.

- Enter the pawn ticket details

- Provide your personal details.

- Choose the payment method that you prefer.

- Wait for the call of the Cebuana Lhuillier transaction agent to confirm the details of the transaction.

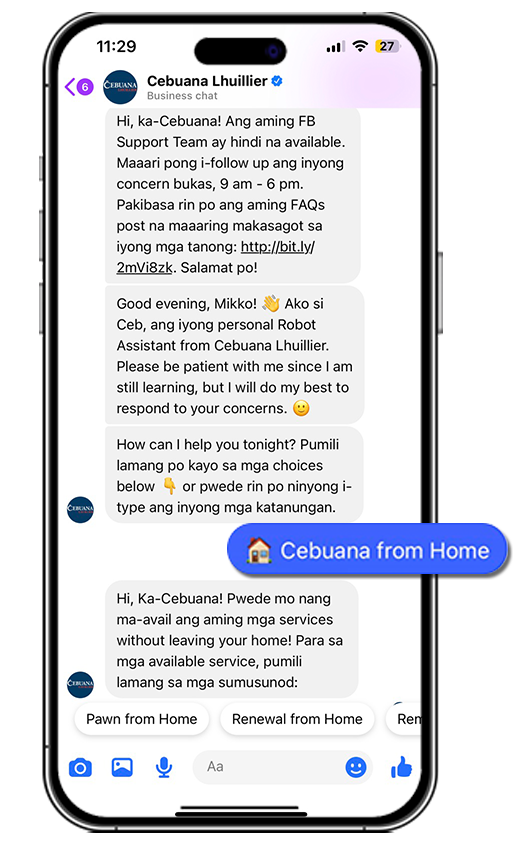

How to Pawn using

Cebuana From Home FB Messenger

- Search for Cebuana Lhuillier with blue checkmark on FB Messenger and type “Cebuana from Home”

- “Choose New Pawn” and type your personal information and jewelry details.

- Once completed, you will receive a call or text from a Cebuana from Home agent to confirm details and schedule the nearest Cebuana from Home rider to your house.

- Cebuana from Home rider will go to your house to appraise the item. Once agreed on the loan amount, the client will receive the cash and pawn ticket

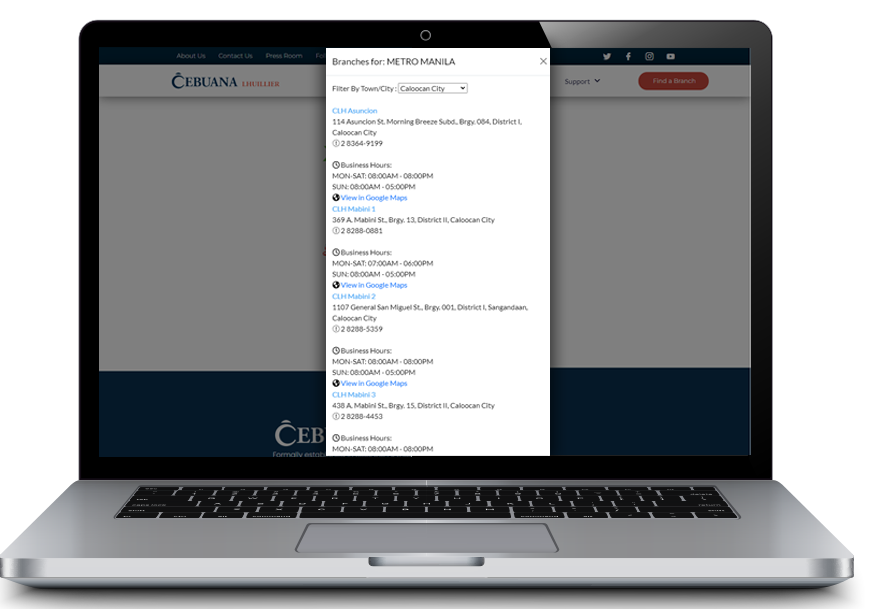

How to do Pawn, Pawn Renewal and Pawn Redemption using

Cebuana From Home SMS

- Send SMS to the branch you want to do your transaction. Access branch contact details go to the ‘Branch and Agents locator’ section of this website.

- Provide the required details by our friendly branch personnel.

- Our branch personnel will guide you throughout the process.