Insurance, what would we do without them? Insurance is the soft cushion that catches us just when we’re about to fall towards the hard pavement of debt. There are various types of insurance, and supposedly, one insurance is enough to cover a few of your expenses. For the most part, people have a general idea of what an insurance is, however, not many are familiar about the ins and outs of an insurance plan. Especially with the current influx of COVID-19 cases, you may need one or two insurance plans to cover any of your unforeseen expenses. Uncertainty is always a part of life, and expenses are always around the corner. In such case, allow us to introduce you to the world of insurance, its different types, and the advantages that you may get from these different insurance plans.

First of all, what is an insurance?

An insurance is defined as a contract, characterized by a policy, in which an individual or a group of people receives financial protection or reimbursement against losses from an insurance company. The company pools clients’ risks to make payments more affordable for the insured. Insurance policies are used to hedge against the risk of financial losses, both big and small, that may result from damage to the insured or her property, or from liability for damage or injury caused to a third party.

Simply put, if you have insurance and something unfortunate and unexpected were to happen, your insurance would make sure that you wouldn’t need to spend a lot of money to cover the expenses resulting from that sudden occurrence. You may ask, “What are these sudden occurrences?” Well, they are some of the things that people fear the most, accidents, calamities, bankruptcy, property damage, you name it. All of the things that may cause huge expenses, these are the “unexpected occurrences” that you may come across at least once in your life, and insurance plans would be there to take a majority of the blow, much like how a bulletproof vest would take much of a damage for a law enforcer during a heated situation.

Okay, but what are the requirements to get an insurance?

Different insurance companies and establishments would usually have varying lists of requirements and benchmarks. It would be best if you were to discuss this with your preferred insurance company, so as not to confuse one pre-requisite from the other. Sometimes, these requirements are tied to their policies, so feel free to ask questions whenever you need to clarify the details.

What are the different types of insurances?

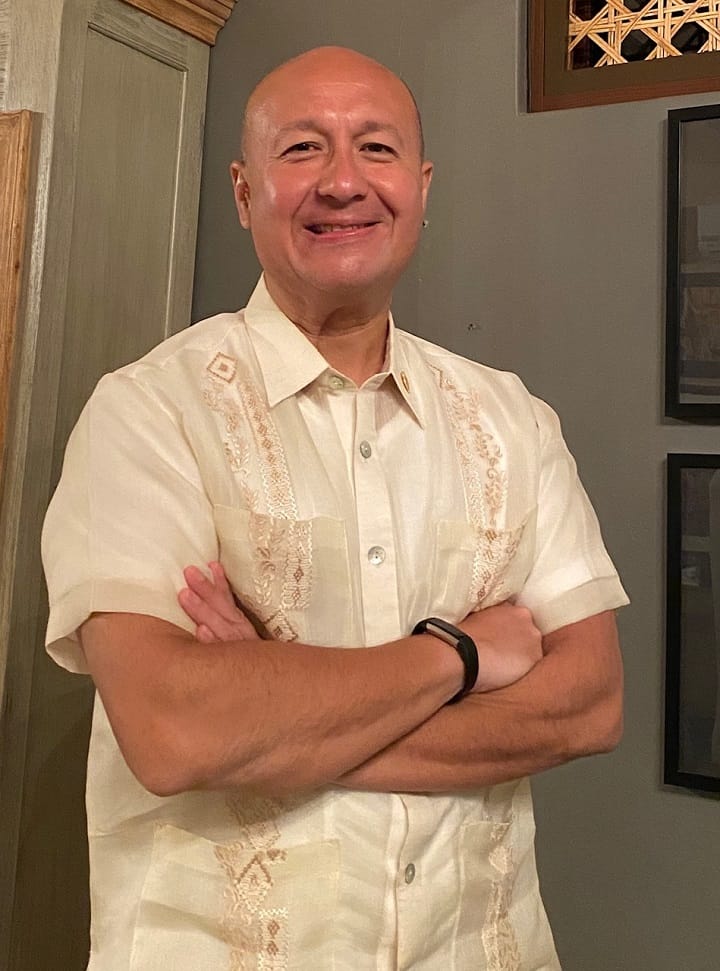

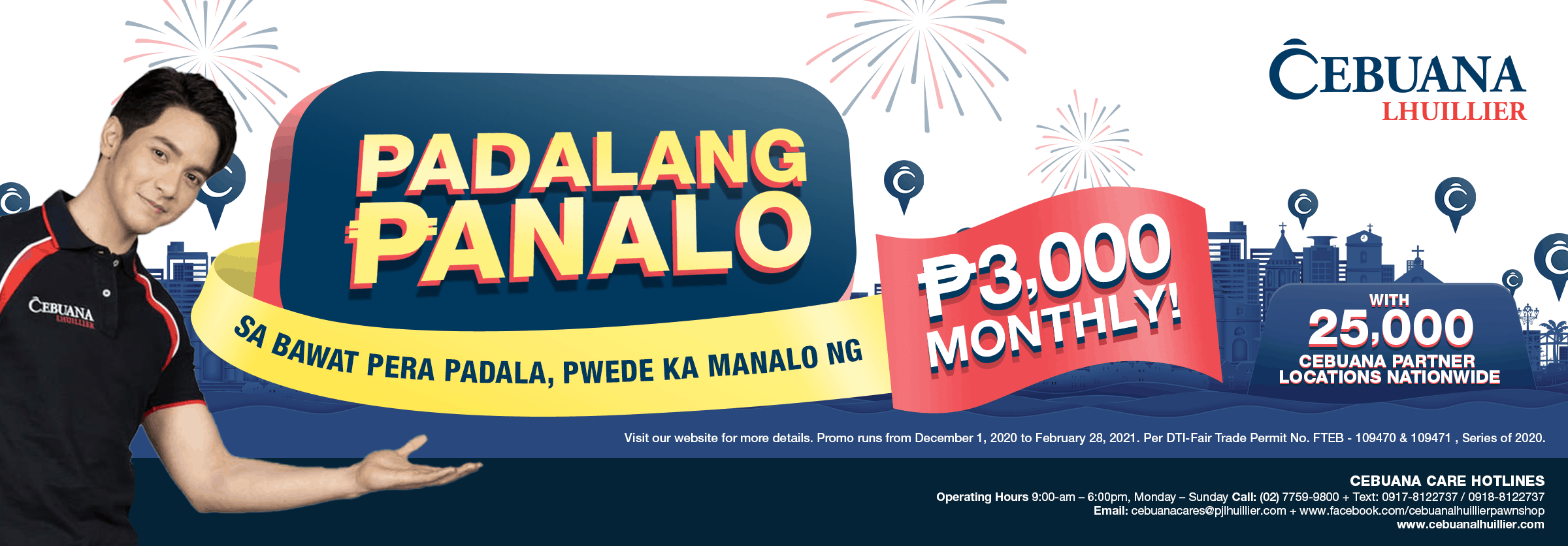

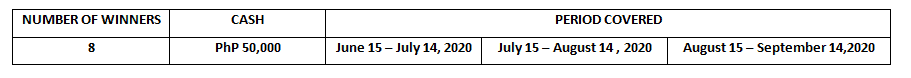

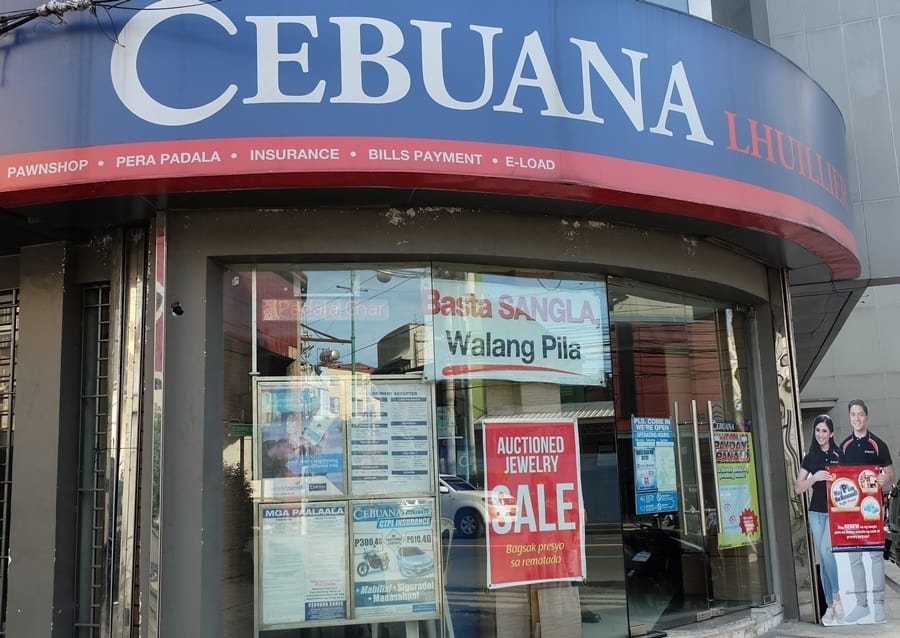

There are many insurance plans, each corresponding to a coverage that they are focused on. We’ve mentioned earlier that there are certain occasions in which a single insurance may be flexible enough to cover other incidences, but for the sake of clarity, we will discuss them in variations and their purposes. Aside from that, we will stick with a familiar establishment when it comes to affordable insurance types. For this, we will focus on Cebuana Lhuillier and their Micro Insurance Services. Their variations are also accessible and affordable, so you may be able to relate with a few of our sample scenarios and their offered Micro Insurances:

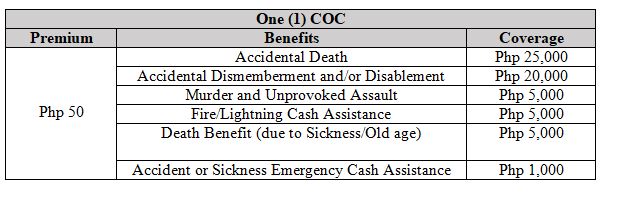

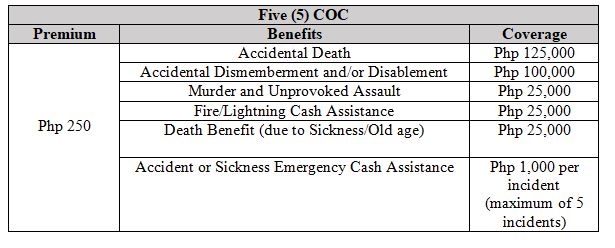

1. Individual Insurance Like Cebuana Lhuillier’s ProtectMAX

Cebuana Lhuiller’s ProtectMAX is a microinsurance product designed for individuals aged 7 to 70 years old with Death Benefit, Accident or Sickness Emergency Cash Assistance, Accidental Dismemberment and/or Disablement, Murder and Unprovoked Assault and Residential Fire Reconstruction cash assistance. For as low as P50, each certificate is valid for four (4) months from the date of issuance and can be availed up to a maximum of 5 certificates per insured.

The Qualified beneficiaries are:

- Legal Spouse

- Child of legal age (18 years old)

- Parents – Mother/Father

- Siblings – of legal age and single; married

This is fairly a new addition to Cebuana Lhuillier’s plethora of Micro Insurance services, but make no mistake, it provides a whole lot of protection, considering that it covers everything, from accidents to unprovoked assault. Even property damage is covered, with their Residential Fire Reconstruction cash assistance. Isn’t that amazing?

2. Business Insurance Like Cebuana Lhuillier’s MicroBiz Protect

Cebuana Lhuillier’s MicroBiz Protect is a comprehensive Property Insurance with Personal Accident coverage, Comprehensive General Liability and AXA Assistance made specifically for micro enterprises. It covers the property and its contents against perils fire and/or lightning and other allied perils such as earthquake, typhoon, flood and others. It also covers MSMEs against burglary and robbery, accidental death, permanent disablement and accidental medical reimbursement. Fees for the micro-insurance policy covering up to 12 months can go as low as PHP540. Aside from that, it is also underwritten by AXA Philippines.

So, if ever you’re the owner of a simple “Sari-Sari” store, never worry about the welfare of your business, as Cebuana Lhuillier’s MicroBiz Protect is here to provide for any unforeseen property damage or accidents.

3. Group Insurance for our Brave Barangay Officials Such as Cebuana Lhuillier’s TanodCARE

“What is Cebuana Lhuillier’s TanodCARE?” you may ask. Well, it is a Group Personal Accident Microinsurance specially designed for barangay tanod officials and its members/personnel. This Micro Insurance requires a minimum number of 30 enrollees aged 18 to 65 years old, enrollees above 65 years old will be accepted subject to 50% cover of the Sum Insured for all Benefits.

Insured members under TanodCARE will be covered with the following occurrences:

- Accidental Death, Disablement & Dismemberment (ADD&D)

- Permanent Total Disability (PTD)

- Unprovoked Murder & Assault (UMA)

- Accident Medical Reimbursement (AMR)

- Burial Benefit (accident/sickness)

- Accident Daily Hospital Income (DHI)

Of course, even our local guardians need a safeguard against sudden expenses, more so that they have a risky occupation, keeping the peace and tranquility of our local community in check.

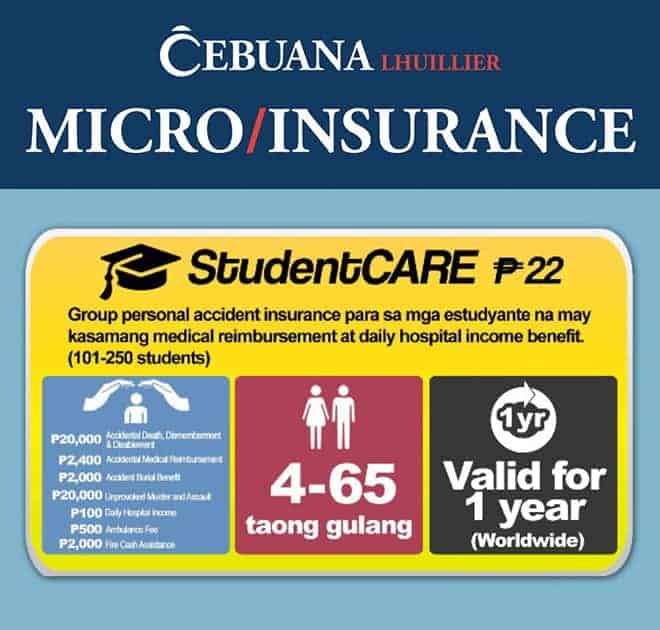

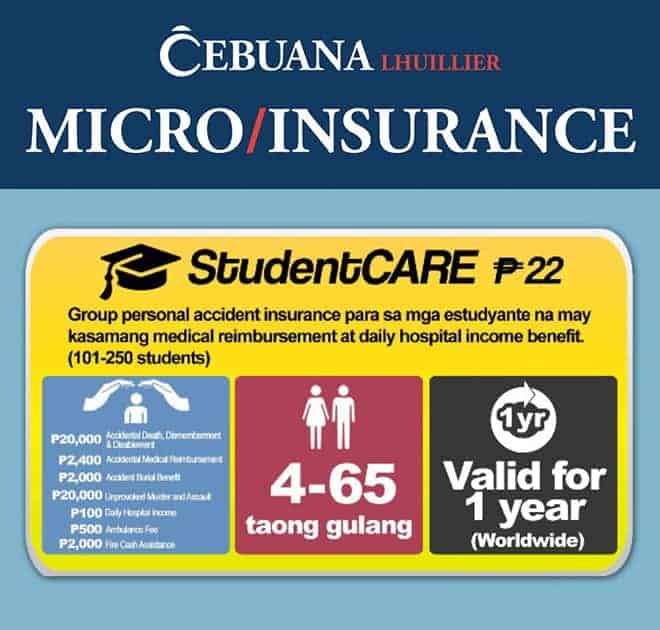

4. Group Insurance for the Future Pioneers of Our Country Such as Cebuana Lhuillier’s StudentCARE

Cebuana Lhuillier’s StudentCARE is a Group Personal Accident Insurance that protects students from various perils 24/7 worldwide. Of course, under the current ECQ, students are allowed to be home-schooled, but after the whole ordeal ends, you may want your kids to be insured, especially if they happen to travel daily towards school. You may never know what lies around the corner. Keep them safe and insured.

Insured members under StudentCARE will be covered with the following:

- Accidental Death, Disablement & Dismemberment (ADD&D)

- Unprovoked Murder & Assault (UMA)

- Accident Medical Reimbursement (AMR)

- Accident Burial Benefit (ABB)

- Daily Hospital Income (DHI)

- Ambulance Fee and Fire Assistance

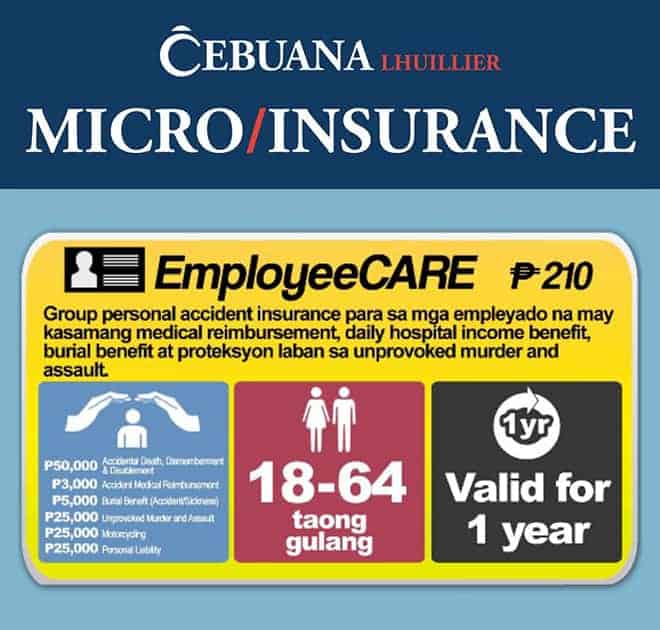

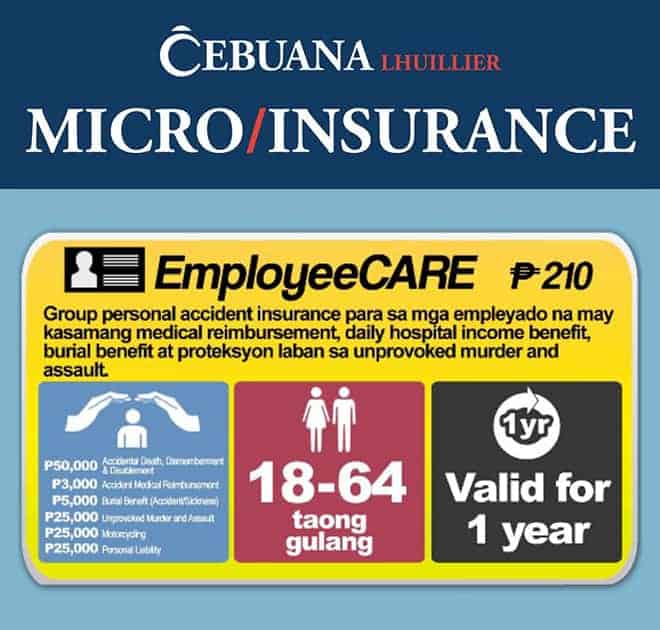

5. Group Insurance for Our Hardworking Citizens Such as Cebuana Lhuillier’s EmployeeCARE

Cebuana Lhuillier’s EmployeeCARE is a Group Personal Accident Insurance specially designed for employees. Obviously, people working under the various umbrella of corporate work also needs their own insurance plan, as even the most sophisticated office places aren’t safe from hazards.

Insured members under EmployeeCARE will be covered with the following:

- Accidental Death, Disablement & Dismemberment (ADD&D)

- Unprovoked Murder & Assault (UMA)

- Accidental Medical Cash Aid, Burial Benefit (Accident/Sickness)

- Motorcycling and Personal Liability

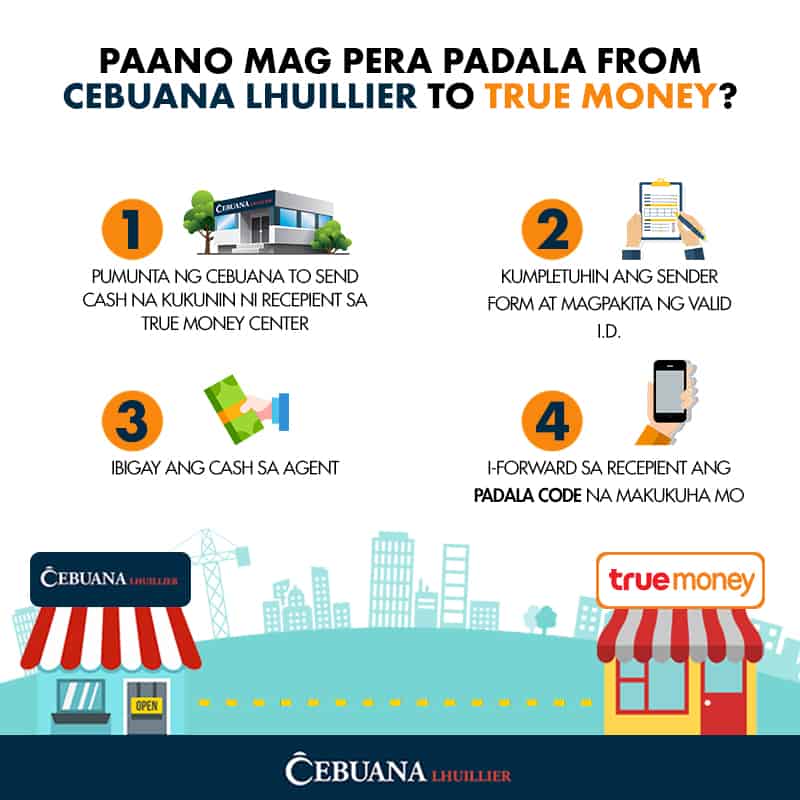

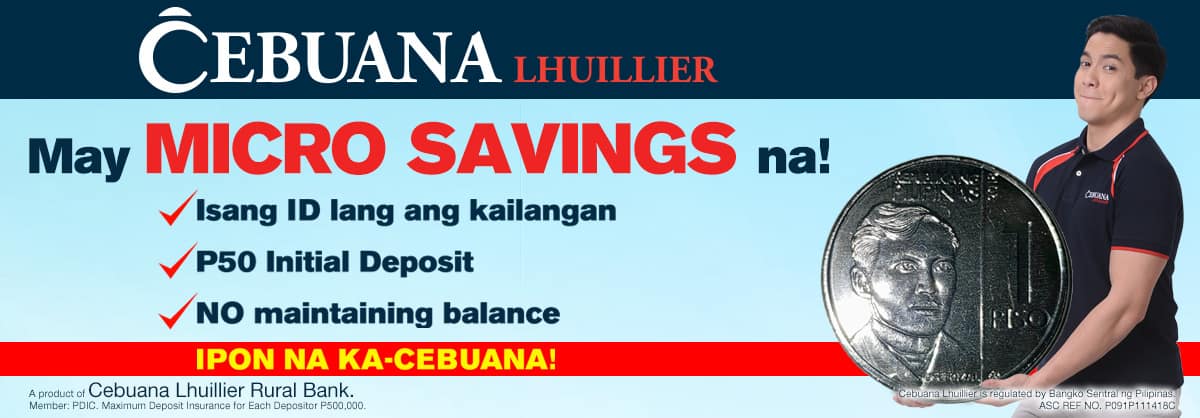

So, those are just a few examples of Micro Insurance plans you may avail from Cebuana Lhuillier. If you’d notice, they cater to the various members of our modern society, whether you’re working within the private sector or the local sector, or even if you aren’t working at all (as evident with the StudentCARE Micro Insurance), insurances are always a viable choice when it comes to avoiding major expenses. You may visit your nearest Cebuana Lhuillier branch now for more information – we assure a fast, easy and secure transaction.