You’re an aspiring businessman/ businesswoman, on your way to turning your dream venture into reality. You have the knowledge and skills to make your dream business run. However, you do not have the needed capital. You suddenly realize that you may just simply apply for a business loan in order to get that needed amount. After submitting all of the requirements, you wait for a certain amount of time, only to receive a call one day from the loaning company telling you that your application was rejected. You ask yourself, what went wrong? Various factors may have affected the process along the way. In such case; here are the possible reasons as to why your business loan was rejected and the equivalent solutions to each of them:

1. Poor Credit History

This is always the primary suspect when it comes to the rejection of loan applications, whether for business or for personal use. A lender will immediately go straight to your credit history, like a parent going straight to their child’s report card, hoping to see whether they had received a good grade or not. A good credit score shows that a business owner has a solid handle on their personal and business credit, which is what every lender likes to see. On the other hand, a poor credit score would deflate any chance or confidence that a lender would have on you. Take note of this for future loan applications, as this is definitely vital.

Solution: Improve on your credit history by paying your past debts on time. Build up your reputation and always remember that you are doing this for a good cause, and that is to acquire funds for your business.

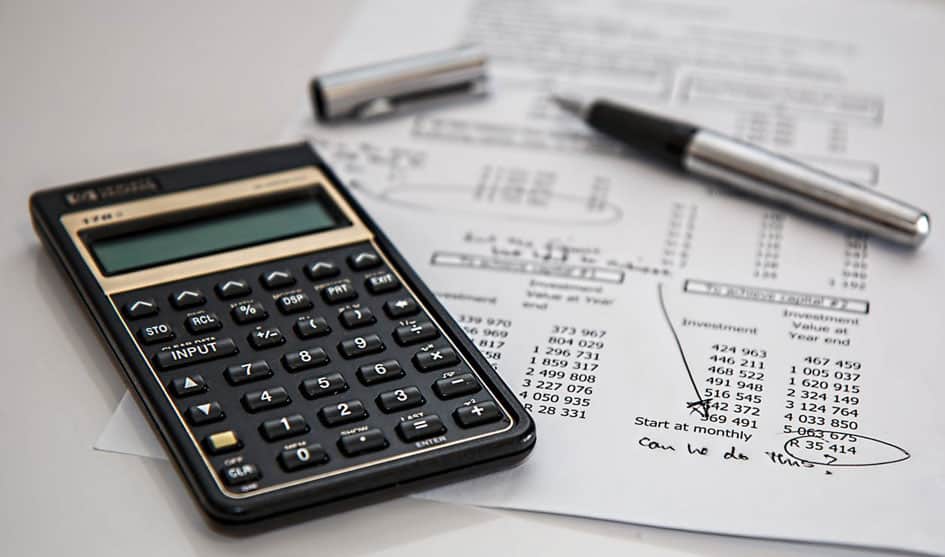

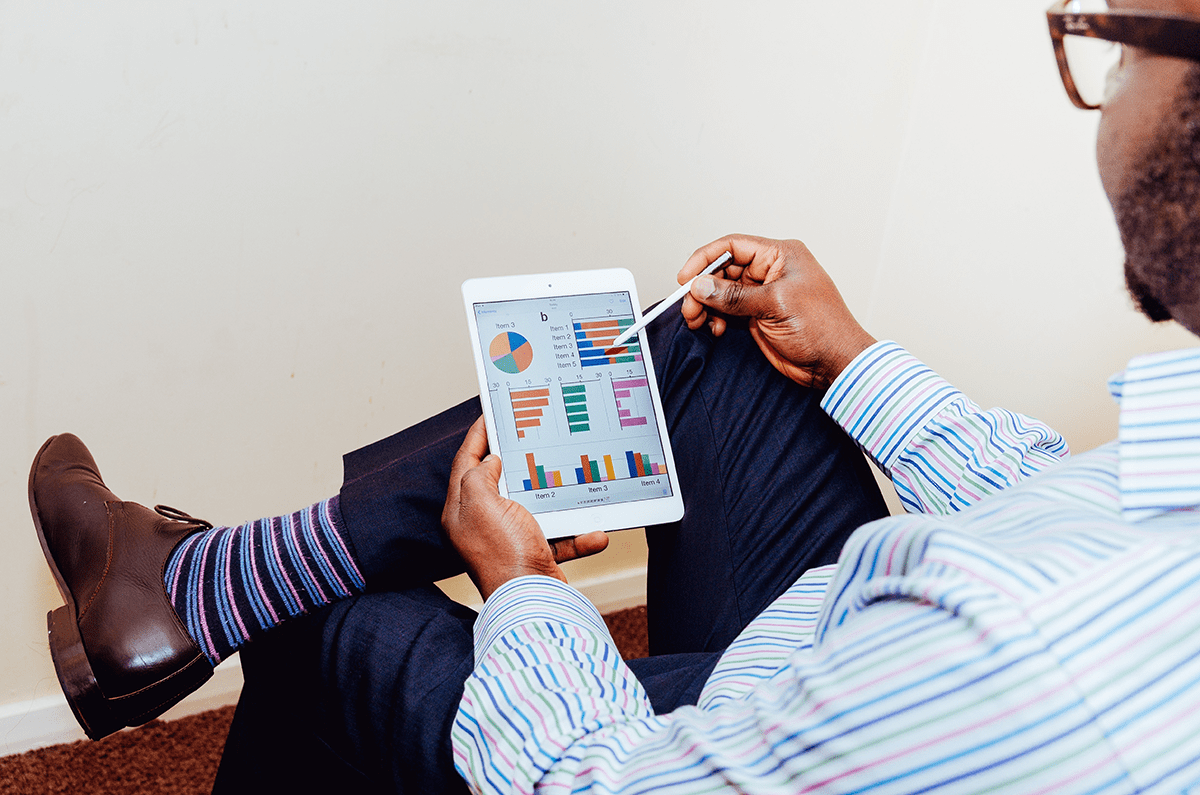

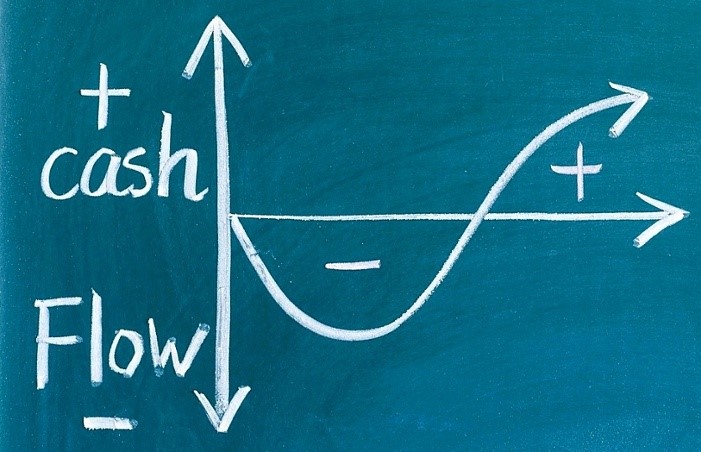

2. Cash-Flow Issues

A cash flow is basically the health of your start up business. Think of it as the air going in and out of your lungs, the same way that money goes in and out of your business. As with both examples, there must be a balanced flow, there shouldn’t be an overflow of outgoing cash, and neither should there be an occurrence of vice versa. If you want to apply for an additional fund for your small-time business, consider managing it well enough first, so that it may exhibit that well-balanced flow of transactions and money. If a lender were to see the continuous flow of income and the minor flow of business expenses, they would definitely keep you on the radar for a loan approval.

Solution: Make sure to manage your business accordingly, with no obstacle on the flow of cash. Do not overspend your resources to reduce the company expenses, while at the same time, secure every cent of your income, so that none would be wasted and misused along the way.

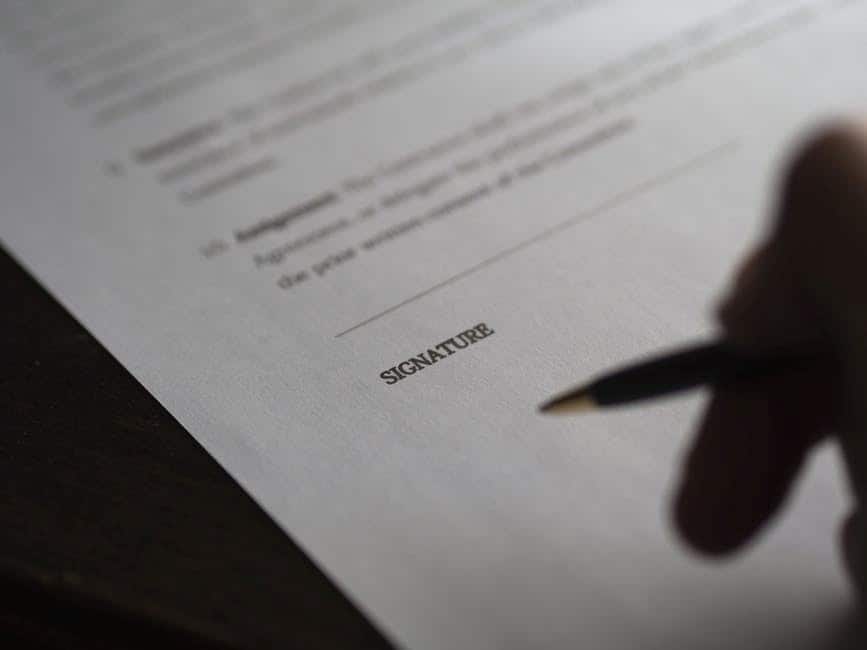

3. Limited Collateral

Collateral is basically something that you have to present to a lender, a clause that would ensure that they would get something from you in the offset that you fail to pay them back. Collateral will also be required if the company has defaulted on a previous loan. Companies with a limited amount of collateral will face challenges when trying to secure bank loans. Business owners should consult with their lenders to find out which types of assets or property can be used as collateral. You might ask, what makes up collateral? What are the types of collateral that you may present to a lender? This might include cars, trucks, real estate, business equipment, and investments. If the business loan is not repaid, the bank can acquire the collateral and sell it.

Solution: Coordinate and negotiate further with the lender if they want more than one type of collateral. Proper coordination would ensure that there would be a win-win situation if ever they were to approve your application for a loan. Be realistic in your offers and you may just land the deal in no time.

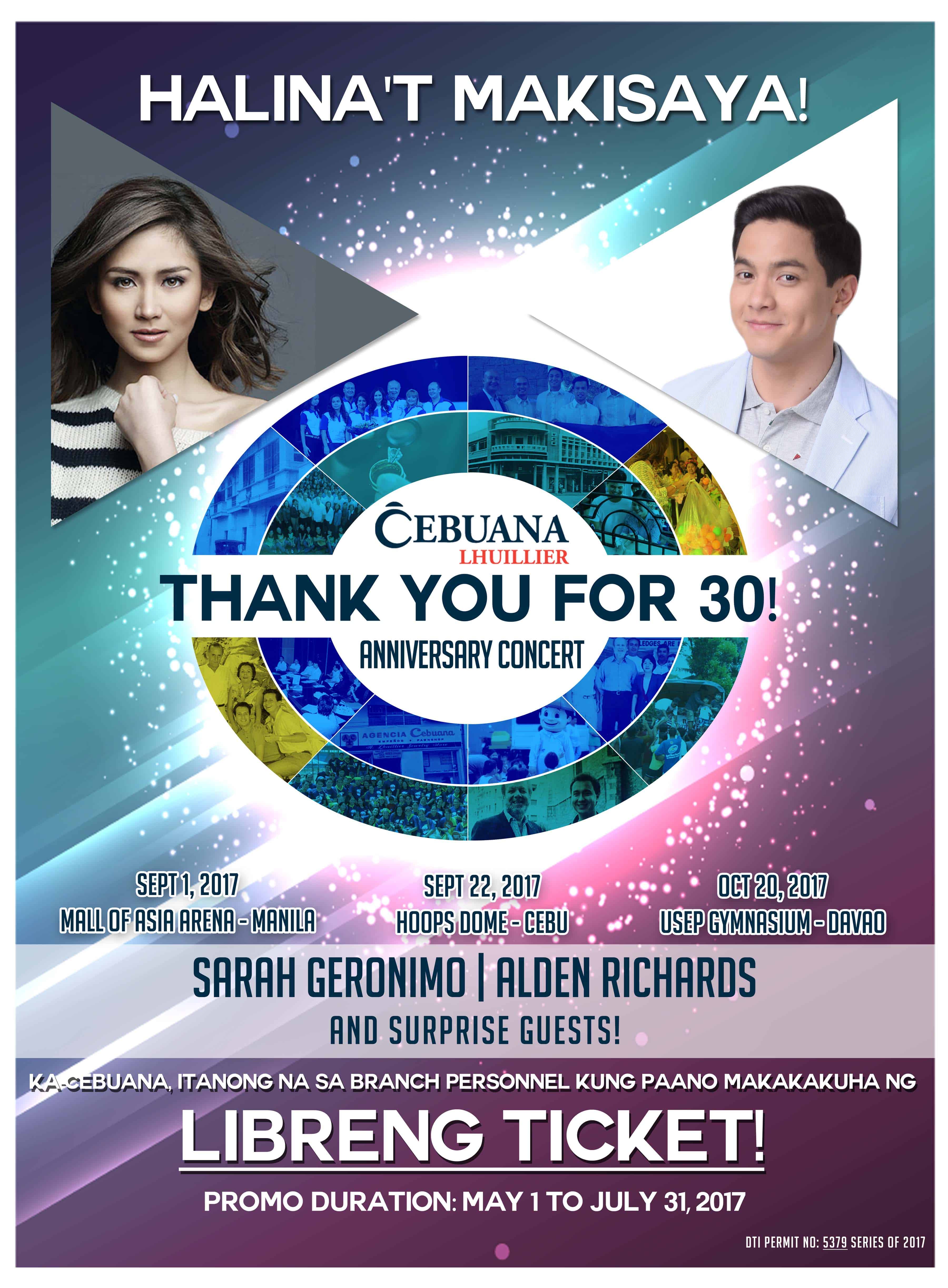

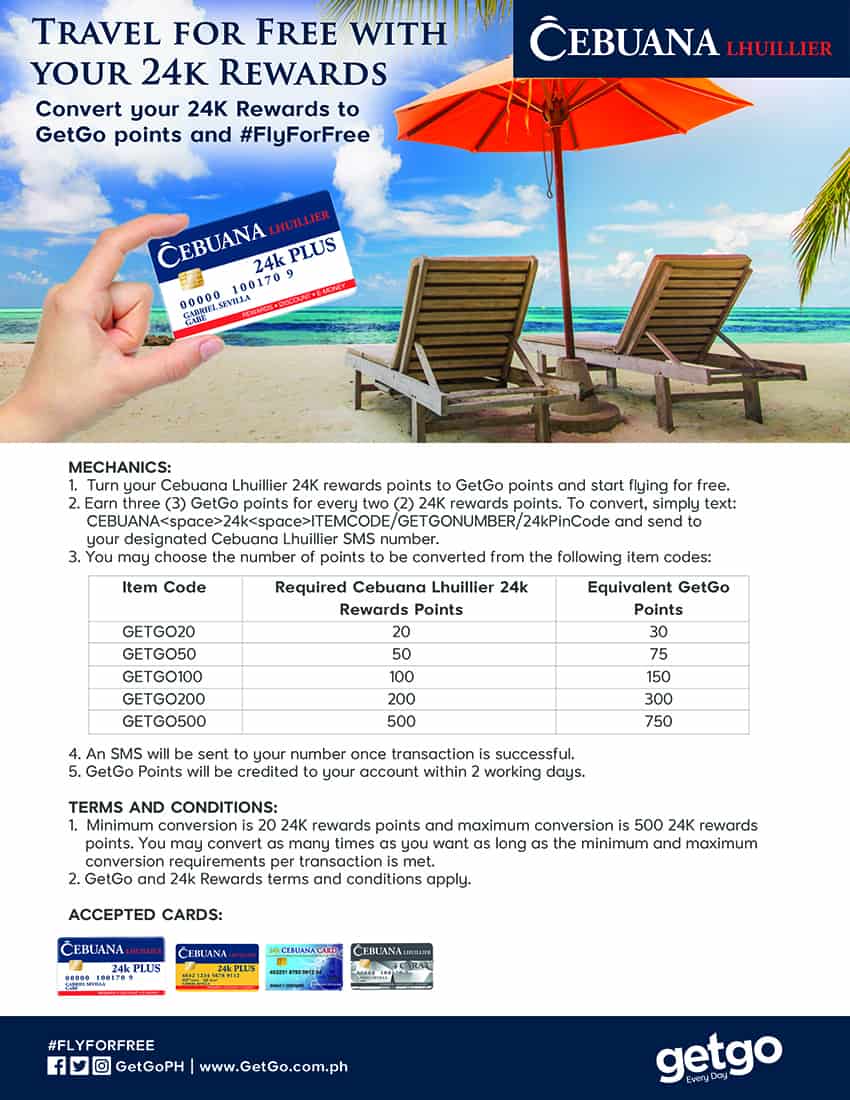

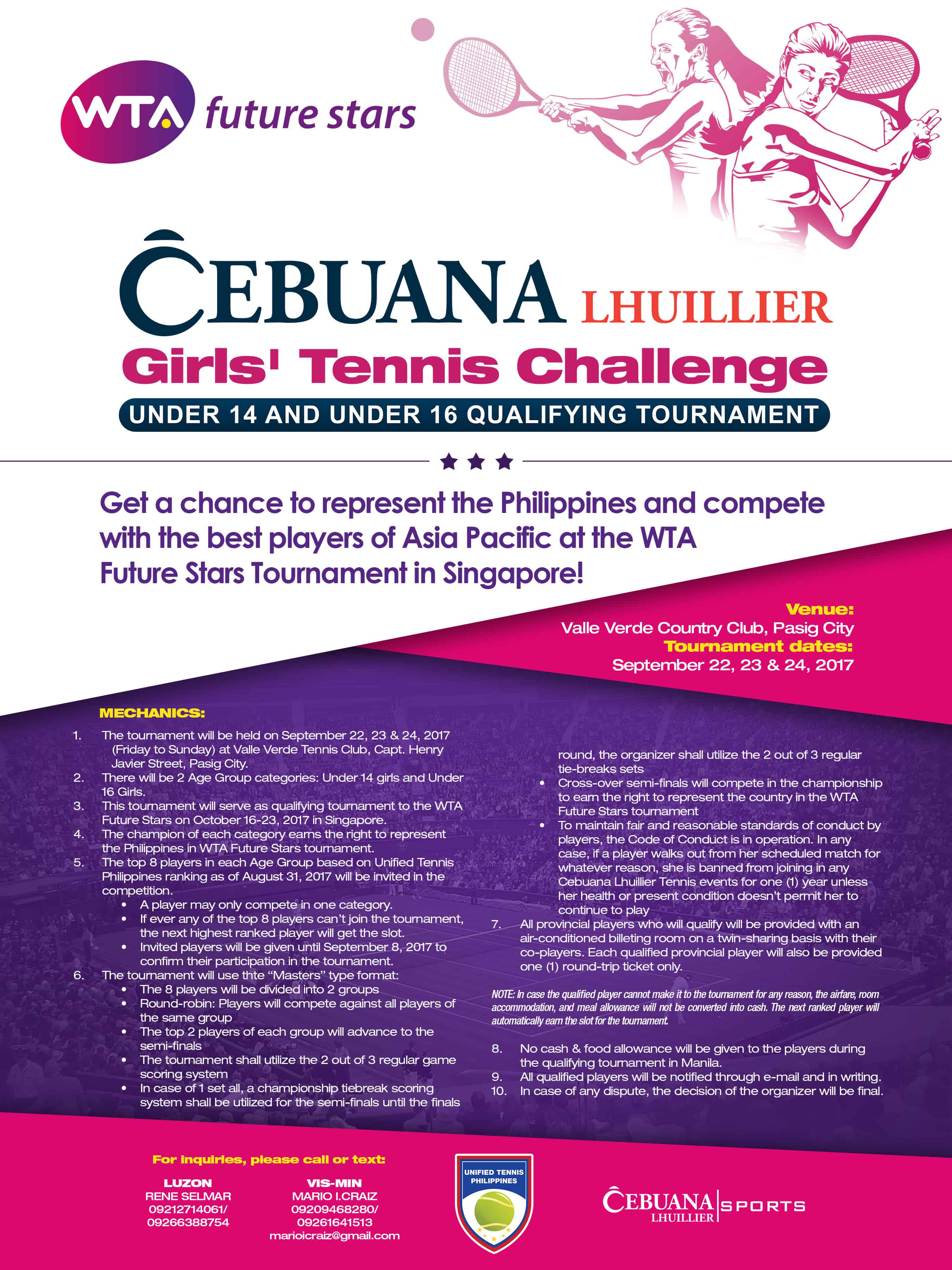

Get a jumpstart on your business venture with a trusted name that offers only the best service possible. Cebuana Lhuillier’s Lucky Loan is definitely your top choice. It is a multi-purpose loan offered to registered entities such as tricycle operators, credit cooperatives and other groups, as well as SMEs such as restaurant and mini groceries, among other businesses. Our network of more than 2,200 branches and online presence give customers unlimited access and utter convenience in applying for a loan. Our five-point application to disbursement process ensures services are delivered on time. So what are you waiting for? Visit your nearest Cebuana Lhuillier branch now – we assure a fast, easy and secure transaction.

Image source:

http://startupbusinessloans.co/wp-content/uploads/2017/05/Females-With-Poor-Credit-Can-Get-These-Business-Loans.jpg

http://media.bem.usnews.com/d2/3a/5c817ff1453387b7dabff707e8ed/140409-creditcard-stock.jpg

Waiting Time is Your Choice

Waiting Time is Your Choice