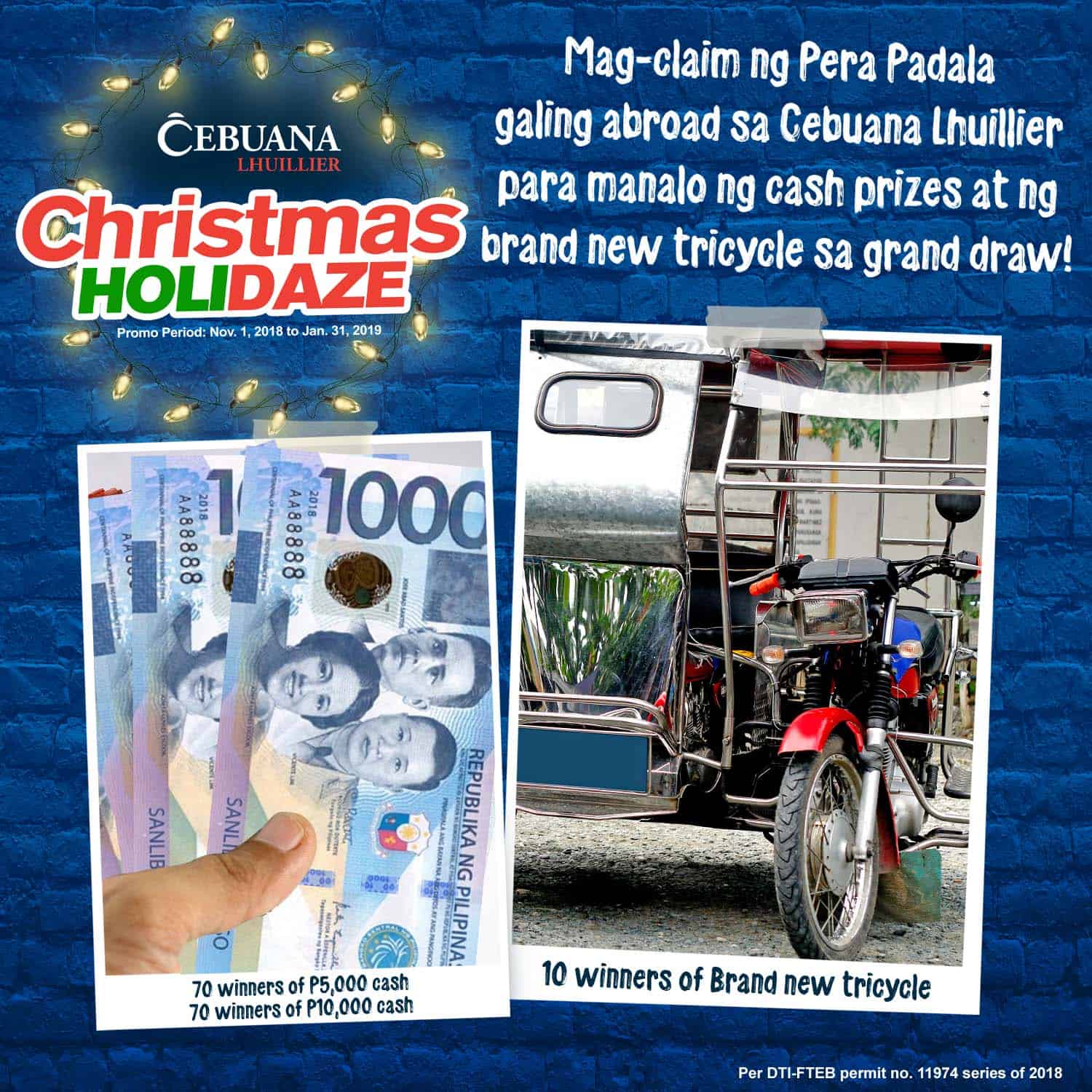

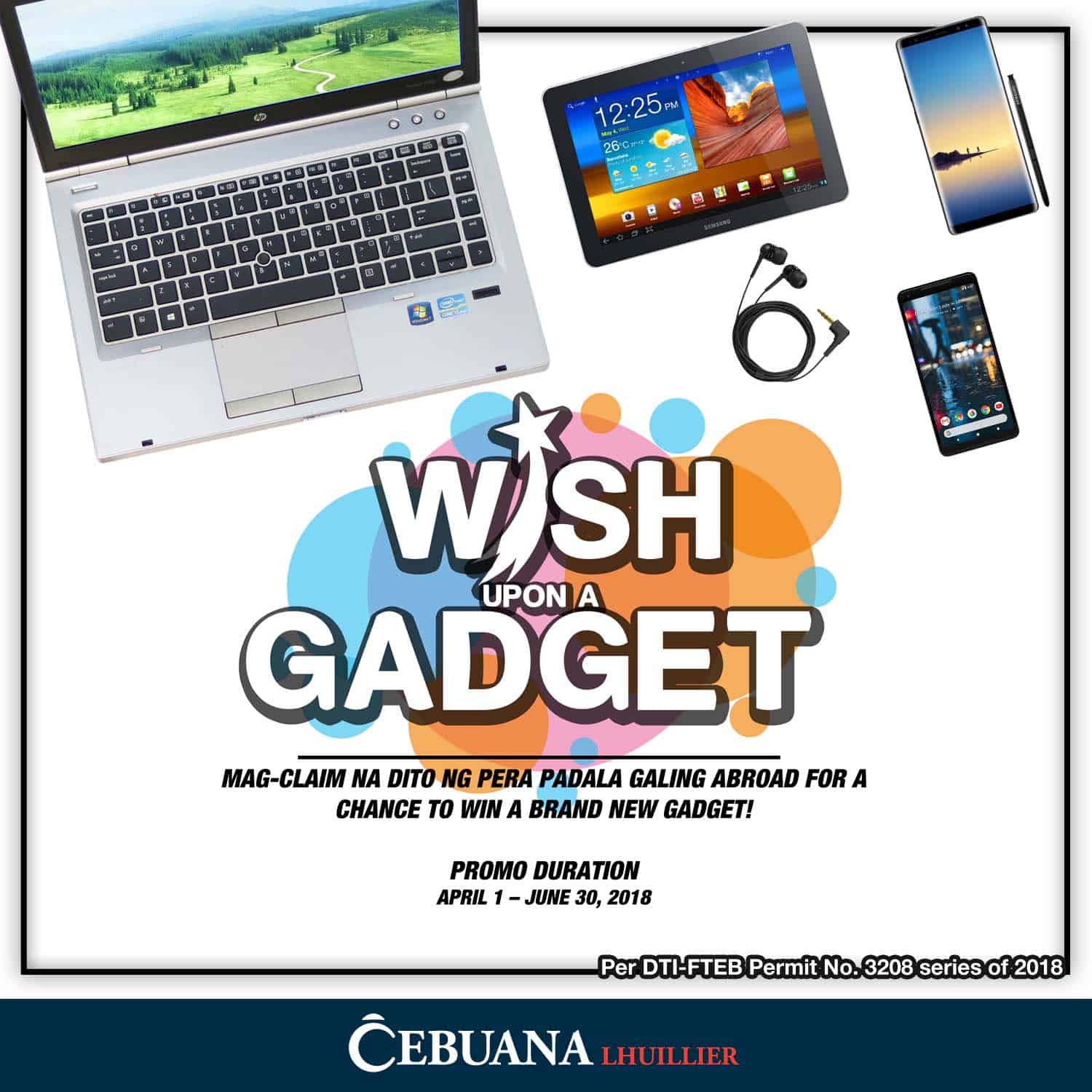

- Ang promo na ito ay para sa mga international remittance beneficiaries na kukuha ng pera sa close to 2,500 branches ng Cebuana Lhuillier mula sa mga participating international partners abroad.

- One (1) valid payout = one (1) e-raffle entry.

- Mas maraming payout, mas malaki ang chances of winning!

- Total of 140 lucky winners ang maaaring manalo ng cash prizes sa 1st and 2nd raffle draw at 10 winners ang pwedeng mag-uwi ng brand new tricycle units sa grand raffle draw.

- Total of 150 winners ang mananalo sa buong promo duration. Almost 2 million worth of prizes ang ipapamigay!

- Ang raffle draw ay magaganap sa Networld Capital Ventures Inc., 3/F The Networld Hub 156 Jupiter cor. Comet Sts., Bel-Air, Makati City 1209 sa mga sumusunod na schedules:

| Raffle Draw | Cut-off period | Raffle Draw date | No. of Winners | Prize |

| 1st raffle draw | Nov. 1 to 30, 2018 | December 7, 2018 | 70 winners | 5,000 cash |

| 2nd raffle draw | Dec. 1 to 31, 2018 | January 4, 2019 | 70 winners | 10,000 cash |

| 3rd raffle draw

(Grand draw) |

January 1 to 31, 2019 | February 8, 2019 | 10 winners | Tricycle |

Reminders:

- Ang mga winners ay pipiliin sa pamamagitan ng computer-based random generation sa system ng Cebuana Lhuillier.

- Maaaring magkaroon ng maraming entries base sa bilang ng qualified transactions.

- Ang client ay maaari lamang manalo ng isang beses kada raffle draw. Hindi na maaaring manalo ang client kapag sya ay nabunot na sa isang raffle draw date. Ang mga earned raffle entries mula November 1 to December 31, 2018 ay hindi narin qualified sa grand raffle draw.

- Lahat ng cash prizes at tricycle units ay transferrable ngunit ang tricycle ay hindi maaaring i-convert sa cash.

- Lahat ng winners ng cash prizes ay makakatanggap ng registered mail na naglalaman ng mga instructions na kailangan nilang sundin para ma-claim ang kanilang cash prize. Dapat nila itong ipresent sa Cebuana Lhuillier branch na i-aassign sa kanila kasama ang kanilang valid I.D.

- Lahat ng winners ng brand new tricycle units ay makakatanggap rin ng registered mail at phone call mula sa marketing representative ng Cebuana Lhuillier para mai-schedule ang delivery ng prize sa transacting branch ng client. Lahat ng logistics, motorcycle registration, insurance at other related expenses ng tricycle ay sasagutin ng Cebuana Lhuillier bago ito i-award sa winning client.

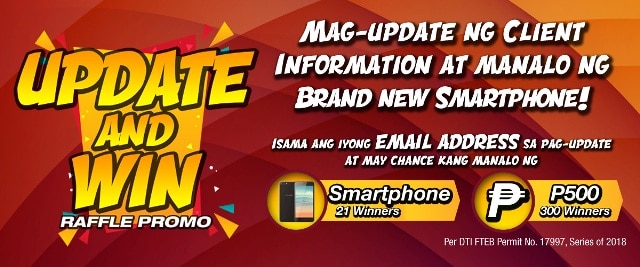

- Lahat ng mga clients ay kailangang i-update ang kanilang personal information (e.g, name, address, active mobile/telephone no., at birthday) sa Cebuana Lhuillier branch na kanilang pinag-tatransactan. Ang kanilang information na naka-record ay kikilalaning tama at magiging basehan sa pagpapadala ng kanilang notification letters.

- Ang hindi pag-receive ng mga winners ng kanilang notification letters dahil sa outdated personal information ay hindi pananagutan ng Cebuana Lhuillier Services Corporation.

- Lahat ng winners ay may animnapung (60) araw mula sa pagkatanggap ng notification letter para i-claim ang kanilang premyo. Lahat ng premyo na hindi na-claim ay mababaliwala pabor ng Cebuana Lhuillier Services Corporation at kinakailangang aprubahan ng DTI.

- Ang 20% tax ng mga prizes na lalampas sa halagang Php10,000.00 ay sasagutin ng Cebuana Lhuillier Services Corporation.

- Lahat ng empleyado ng P.J. Lhuillier Group of Companies, Ad/ Creatives Agency, PR and Media agencies at ang kanilang mga kamag-anak na abot sa second degree of consanguinity or affinity ay hindi maaaaring sumali sa promo na ito.