Table of Contents

Introduction

Why You Should Remit Money Through Cebuana Lhuillier

Money Remittance Services at Cebuana Lhuillier

Ways To Remit Money at Cebuana Lhuillier

Conclusion

Introduction

Money remittance services are often used by Overseas Filipino Workers (OFWs) to send money back home to their loved ones. These funds can then be used for daily expenses, emergency purchases, or quality of life improvements. In developing countries, such as the Philippines, these remittances may serve as a primary source of income.

People in the Philippines can also use money remittance services to send funds to their relatives abroad. This is a secure way of paying for overseas tuition fees, investments, or travel expenses.

If you are looking for a reliable money remittance service provider, turn to none other than Cebuana Lhuillier. Having been in business for several decades, you can trust that we have the knowledge and experience to provide you with nothing but the best service.

Money Remittance Services at Cebuana Lhuillier

Domestic Remittance

Through our domestic remittance services, you can send money to your loved ones, no matter where they are in the Philippines. We have branches and partner outlets throughout the country to help you with your financial needs.

International Remittance

Our international remittance services are perfect for those who want to send money from abroad. We have several international partners in Europe, Middle East, Africa, the USA and Canada, and the Asia-Pacific

Why You Should Remit Money Through Cebuana Lhuillier

Cebuana Lhuillier is one of the top remittance service providers in the Philippines. This means that we are able to provide you with benefits that you can’t get anywhere else! You can take advantage of the following:

Convenient Services

Our team has always been dedicated to finding new ways to make our money remittance services accessible to a wider client base. That is why we offer our services through several physical and digital platforms.

One example of our helpful remittance solutions is our Remit to Account service. This domestic remittance service allows you to send money directly to the recipient’s bank account without needing your own.

We also have an Online Appointment System that allows you to set a transaction appointment through our website at 24k.cebuanalhuillier.com. You won’t have to waste your time waiting in line and filling out forms. All you have to do is bring your Appointment Code on the scheduled date, and then your transaction can be processed quickly by the branch personnel.

Exclusive Perks

If you are a member of our 24k Loyalty Program, you can earn reward points for every money remittance transaction. You can then use these points to pay for the fees of your succeeding remittance transactions. Aside from this, you will have access to exclusive discounts and promos, as well as an online portal where you can manage your transactions.

Accessible Locations

Cebuana Lhuillier has more than 2,500 branches nationwide, some of which are standalone PeraPadala branches dedicated to providing our money remittance services. We have also partnered with trusted banks and financial institutions for those who want to take advantage of our Remit to Account service. In summary, we have 2,500+ branches and 25,000 partner outlets and 1.7M physical outlets and global virtual touchpoints.

Customer-Centric Staff

No matter how much money you want to remit, you can rely on our team to process your transaction as quickly and safely as possible. Our branch personnel will also provide you with the assistance you need to fill out the required forms.

Ways To Remit Money at Cebuana Lhuillier

Since we offer money remittance services through our physical locations and online platforms, you can be sure that we have a solution that works for you.

Cebuana Lhuillier Branches

If you are sending money domestically through one of our branches, visit the nearest location and fill out the PeraPadala form. You must also bring at least one valid ID so our branch personnel can verify your identity. Once you have paid the full amount and necessary fees, you will be given a control number, which the recipient will use to claim the cash. Our partners follow the same process for international remittance services.

Those claiming money must visit a Cebuana Lhuillier branch or international partner and provide the accomplished form, valid ID, and reference number.

eCebuana App

As part of our commitment to make our microfinance services more accessible to our clients, we created the eCebuana app. You can download the application on your mobile devices to access our online financial solutions, such as bills payment and money remittance services.

Through the app, you can transfer money from your Cebuana Micro Savings account to another. Recipients can then claim the cash at their nearest branch, which grants them a 20% reduction in fees. The app also allows you to send funds to other banks through Instapay. While International Remittance is not yet available online, with the recent partnership with Western Union, Cebuana Lhuillier clients may now receive international remittance via eCebuana app.

Step 1: Log in and input your 5-digit PIN code

Step 2: Go to Services Tab and select ‘Receive Money’

Step 3: Click the ‘Western Union’ logo

Step 4: Complete the details and add the 10 digits reference number from Western Union

Step 5: Read and agree on the terms and conditions and click confirm to proceed. You will receive a One-Time PIN via your mobile number.

Step 6: Transaction confirmation will be displayed in the app and will be sent via email. The amount received will be reflected on the users’ transaction list in their account balance. Wait for at least 5 minutes.

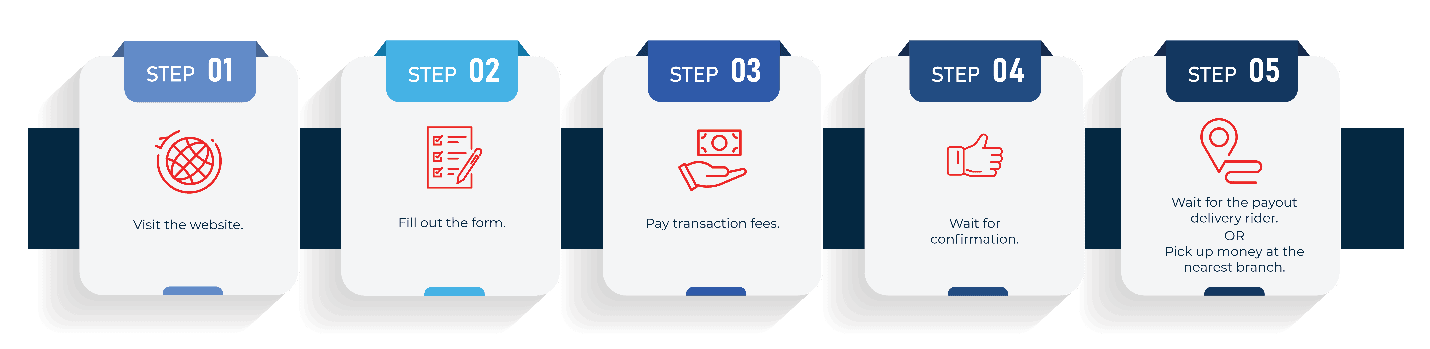

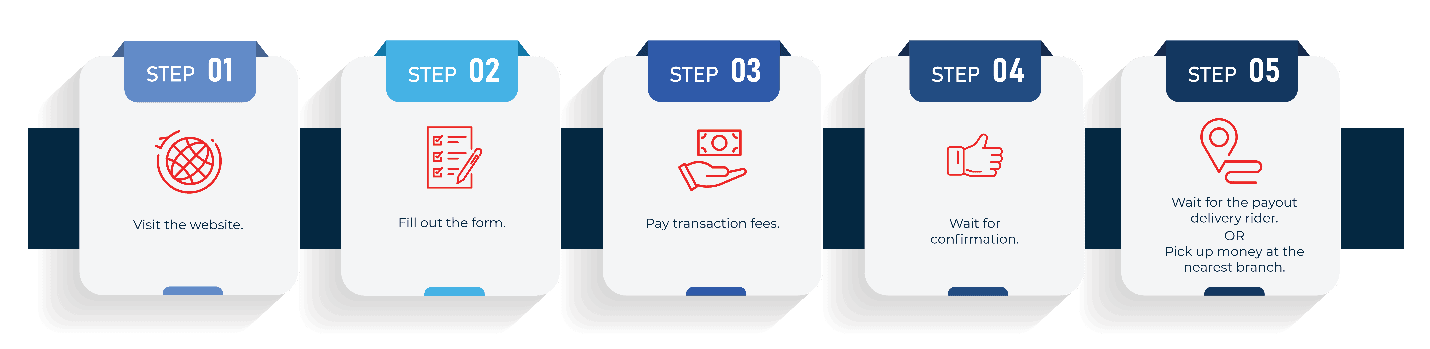

Cebuana From Home

If you want a quick and safe way to send cash domestically, Cebuana From Home is an excellent option for you. This service is especially convenient for those who are staying home amid the COVID-19 pandemic.

All you have to do is fill out the remittance form on the CebuanaFrom Home website and pay the required fees. Once your transaction is processed, you will receive a call or email from one of our agents to confirm your request. One of our payout delivery riders will then travel to your recipient’s location and directly deliver the cash.

If you prefer, you can also have the recipient pick up the money at one of our branches.

Conclusion

Whether you are sending money to relatives in your province or receiving cash from a loved one abroad, you should make sure that you work with a reliable remittance service provider, like Cebuana Lhuillier. We offer exceptional solutions to help you achieve your financial goals.

To learn more about our money remittance services, reach out to us today. We will be more than happy to address any of your questions or concerns. Our team looks forward to hearing from you!