1. THE AGREEMENT. This Agreement governs the relationship between the e-Service Client (the “Client”) and Cebuana Lhuillier Pawnshop (the “CLP”). CLP reserves the right to adjust, modify, amend or supplement these terms and conditions as the service may require without the need of prior notice. The Agreement or any changes thereto shall take effect immediately upon the processing of the e-Service enrollment transaction.

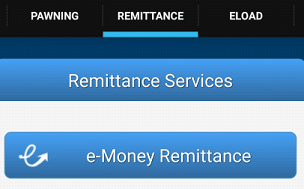

2. THE e-SERVICE. 24k Cebuana Card’s e-Services (Electronic Services) include access to the Client’s 24k Cebuana Card account so that the Client can do inquiries and transactions through the Internet and/or the Mobile Phone, and the use of the 24k Cebuana Card for e-Money transactions.

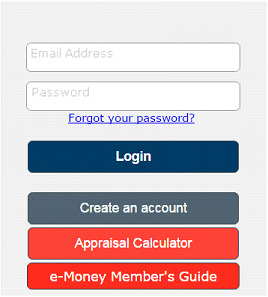

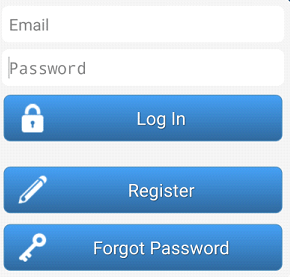

3. ACCESS TO e-SERVICE. To access the Client’s 24k Cebuana Card account through CLP’s e-Services, the client must have a valid Mobile Phone Personal Identification Number (MPIN) for Mobile Phone, email address and an online password for 24k Online Internet Portal, and biometrics record and a 24k Cebuana Card for e-Money transactions.

4. ACCURACY OF INFORMATION. The Client hereby warrants that all information pertaining to his/her identity and personal circumstances are true and correct. Further, the Client confirms, declares and acknowledges that the mobile phone number and email address provided to CLP is/are owned/in the control of the Client and that, any communication from and to the said mobile phone number and/or email address is and shall be with the knowledge of and within the control of the Client. The Client confirms and undertakes to inform CLP forthwith upon any change in the mobile phone number, email address and/or any other change that may affect the provision of e-Service to the Client.

The Client is responsible for verifying the e-Service transaction history details and records to make sure that there are no unauthorized transactions. The Client should likewise review and reconcile transaction records/details for any errors or unauthorized transactions promptly and thoroughly.

5. ACCOUNT AND CARD SECURITY. The Client shall be responsible for the security of his/her 24K Cebuana Card and for the maintenance of the confidentiality of his/her MPIN and/or online password. Therefore, all e-Service transactions and activities made on the 24K Cebuana Card are conclusively presumed to be done by the Client and the Client shall be liable therefor. The Client has the option to change his/her MPIN and online password from time to time as he/she deems necessary.

In case of loss of the 24k Cebuana Card, the Client shall immediately inform CLP through the Cebuana CARES Hotlines of such loss within twenty-four (24) hours, via telephone from 9:00 AM to 6:00 PM, Monday to Sunday or thru a written report. Cancellation of the 24k Cebuana Card shall be processed only upon proper authentication of the phone call or the signature in the written report, as the case may be. All activities and transactions made thru the use of the 24k Cebuana Card prior to the report of the loss shall continue to be the liability of the Client.

The remaining Reward Points and/or Cash Value in the cancelled 24k Cebuana Card shall be transferred to the replacement 24k Cebuana Card.

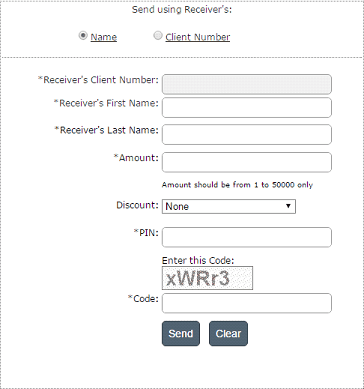

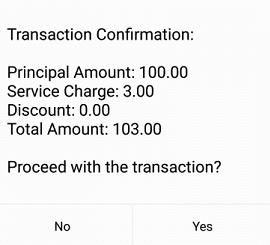

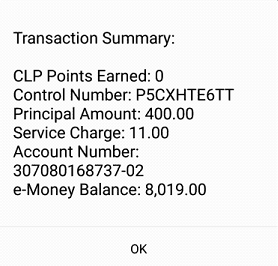

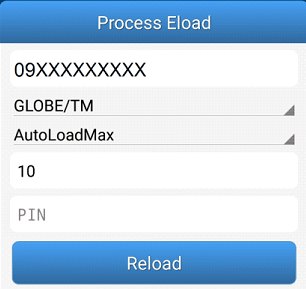

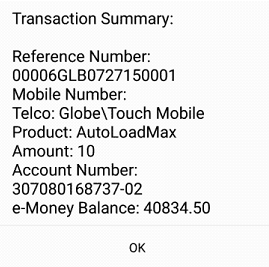

6. REFERENCE NUMBER. Each successful e-Service transaction via mobile phone, internet or e-Money shall be evidenced by a system-generated Reference Number, which shall be transmitted to the Client’s enrolled mobile phone number, e-mail address or validation form, whichever is applicable, for records purposes. The Reference Number shall be the basis of the CLP in investigating any complaints lodged by the Client.

7. TRANSACTION DATE. CLP will effect the Client’s transactions, provided there are sufficient reward points and/or cash value available in the Client’s 24k Cebuana Card account. It is the responsibility of the Client to ensure that sufficient reward points/cash value are available in the Client’s 24k Cebuana Card at all times to cover any of the transactions, immediate or scheduled, and that the 24k Cebuana Card is active. Any charges or penalties as a result of an unsuccessful transaction due to insufficiency of reward points/cash value or cancelled card will be the sole responsibility of the Client and shall be for the account of the Client.

8. e-MONEY TRANSACTIONS. The 24k Cebuana Card, as an e-Money instrument, is re-loadable. The e-Money may only be redeemed at face value. It shall not earn interest or rewards and other similar incentives convertible to cash, nor be purchased at a discount. Further, e-Money is not considered a deposit account hence, it is not insured with the Philippine Deposit Insurance Corporation (PDIC).

The e-Money is subject to aggregate monthly load limit of One Hundred Thousand Pesos (Php100,000.00) unless a higher amount has been approved by the Bangko Sentral ng Pilipinas (BSP).

All e-Money transactions are subject to the rules and regulations of the Bangko Sentral ng Pilipinas (BSP) and the Anti-Money Laundering Council (AMLC) and all parties hereto are mandated to comply with said rules and regulations.

9. FEES, RATES AND OTHER CHARGES. The use of e-Service via mobile phone and 24k Online facility is free of charge. Only fees for the use of text messages and internet connection shall apply and are payable as agreed upon between the Client and the Mobile Phone/Internet Service Provider. However, CLP reserves the right to impose reasonable charges and the Client hereby authorizes CLP to impose said charges accordingly in the future or in such cases as CLP may deem necessary.

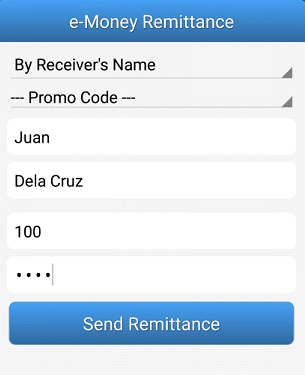

For e-Money transactions, the Client agrees to pay other fees and charges and applicable taxes related to the 24k Cebuana Card and its use, as maybe imposed by CLP and/or its partner merchants, such as, but not limited to, remittance, processing, load and encashment fees. Fees and other charges, as may be applicable, shall be inclusive of all applicable Philippine taxes and shall be debited from the e-Money cash value or paid upfront. Should these fees and other charges result in a debit balance in the e-Money cash value, the amount shall be immediately due and demandable from the Client. The amount of fees and charges may be revised from time to time as CLP may deem necessary without the need of prior notice.

10. TERMINATION/SUSPENSION OF e-SERVICES. CLP reserves the right to terminate or suspend, either in partiality or totality, the e-Service for any client, without prior notice, and in any of the following instances: a) discovery of any form of fraud; b) violation of any of the provisions of the e-Service terms and conditions and rules and regulations of CLP supplementary thereto; and c) other grounds warranted by law. All reasonable effort will be made CLP to advise the Client of the circumstances of termination or suspension. Restoration of suspended service shall be the sole prerogative of CLP.

The Client may request that CLP terminate the access to e-Services permanently by submitting a written request to the Cebuana CARES or any of the Cebuana Lhuillier Pawnshop branches. The Client will remain responsible for any transactions/activities made on his/her 24k Cebuana Card until the time of cancellation. CLP shall not be liable for any and all remaining scheduled transactions that the Client previously set up.

11. DISPUTES ON TRANSACTIONS. The details in the e-Service transaction records are presumed true and correct unless the Client notifies CLP thru Cebuana CARES in writing of any disputes thereon within fifteen (15) days from the date of transaction. If no dispute is reported within the said period, all transactions details and records are deemed true and correct. Disputed transactions shall only be adjusted once the claim/dispute has been properly processed, investigated, and proven to be in favor of the Client.

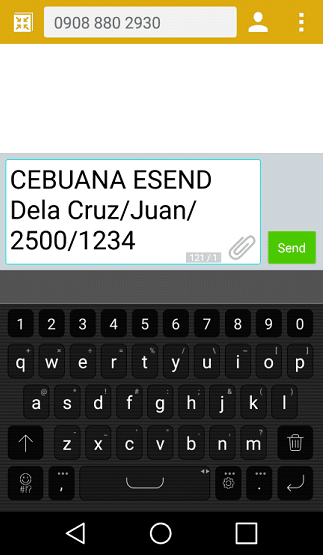

12. COMPLAINTS AND INQUIRIES. The Client should direct e-Service complaints and inquiries to Cebuana CARES Hotlines via the following:

Phone : (02) 7759-9800/(02) 8779-9800

SMS : 0917-81CARES (22737) GLOBE / 0918-81CARES (22737) SMART

Email : [email protected]

Address: 5/F PJL Corporate Centre – Annex II 1782 Nicanor Garcia corner Candelaria Sts. Brgy. Valenzuela, Makati City 1208

13. DISCLOSURE. CLP shall keep all 24k Cebuana Card e-Service enrollment files in strictest confidence. CLP may, however, obtain, exchange or release information to its associates, affiliates, subsidiaries, officers, employees, agents, lawyers and other consultants, pre-paid/debit/credit bureaus or any such persons as CLP deems necessary, or as required by law, rule or regulation.

14. EXCLUSION FROM LIABILITY. CLP makes no warranty, express or implied, regarding the performance of this Agreement or the e-Service functionalities or other services offered hereunder.

The 24K Cebuana Card e-Service is offered on an “AS IS” or “AS AVAILABLE” basis without warranties of any kind, except those required by law and other rules and regulation issued by pertinent government agencies. CLP further makes no warranty (1) as to the content, quality or accuracy of data or information provided by CLP hereunder or received or transmitted using the e-Service Channels; (2) as to any service or product obtained using the e-Service; (3) that the e-Services will be uninterrupted or error-free; or (4) that any particular result or information will be obtained.

CLP shall not be liable for any loss, added cost, compensation, damage or liability that the Client may incur as a result of any delay, interruption or termination of the e-Service transaction whether caused by administrative error, technical, mechanical, electrical or electronic malfunction or any cause beyond CLP’s control (including but not limited to acts of God, labor disputes, failure of communication lines, interconnection problems, mobile phone signal/reception problems, interference or damage by third parties).

15. LIMITATION OF LIABILITY. Subject to the provisions herein, if CLP is found liable for any act or omission for any reason whatsoever, the liability of CLP shall be limited to the amount of the relevant transaction or actual damages to the Client, whichever is less. CLP shall not be liable to the Client for any indirect, special or consequential loss or damages arising from the use of 24k Cebuana Card e-Service.

16. GOVERNING LAW. This agreement shall be governed by the laws of the Republic of the Philippines and all suits arising from this agreement shall solely be cognizable by the proper courts of Makati City.