Cementing its commitment to help communities prepare for disasters, Cebuana Lhuillier, the country’s leading microfinancial solutions provider, recently introduced the ACP Gold, an innovative addition to its line of insurance offerings. An iteration of the company’s flagship insurance product, which is the Alagang Cebuana Plus, the ACP Gold offers an added microlife component while also providing coverage for accidental death/dismemberment & disability (ADD&D), fire cash assistance (FCA) and a rider benefit for unprovoked murder and assault (UMA).

Jean Henri Lhuillier, President and CEO of Cebuana Lhuilier, stressed the relevance of the ACP Gold to Filipinos. “The Philippines frequently suffers from the effects of disasters, and while Filipinos are a strong people, many families and communities need all the help they can get to lessen the impact of calamities. The ACP Gold answers a need for a product that will help assist affected individuals bounce back from challenging times. It is a valuable tool that empowers Filipinos in times of crisis, especially natural disasters.”

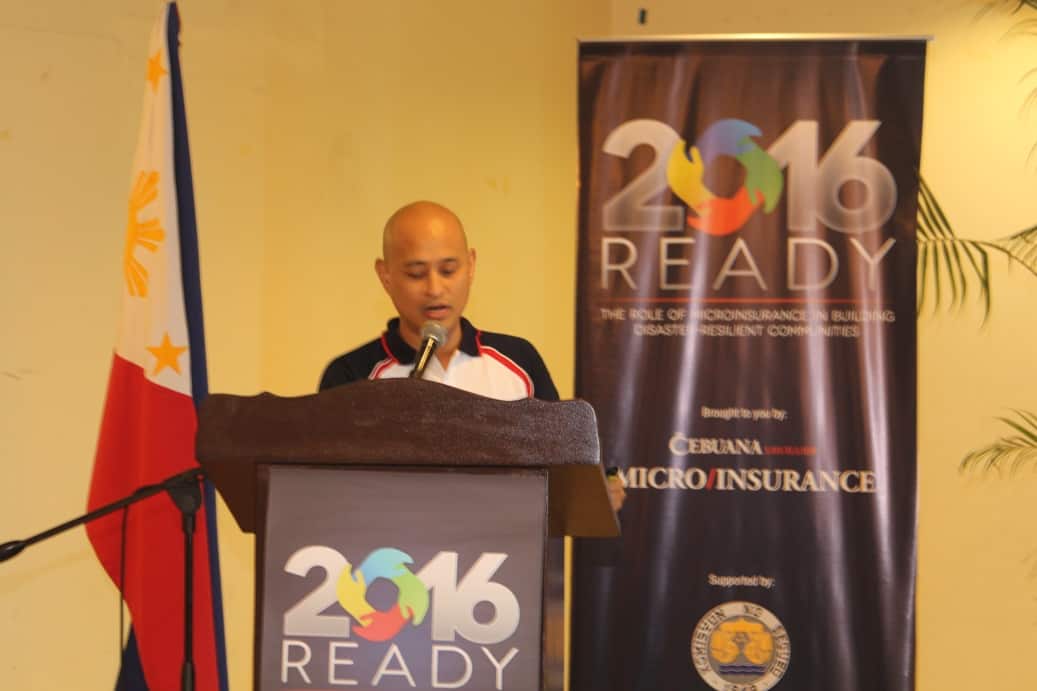

The new product was launched during Cebuana Lhuillier’s series of road shows, which came after the success of its disaster resilience forum last January in Makati. The company, with the support of the Insurance Commission and GIZ (The Deutsche Gesellschaft für Internationale Zusammenarbeit), mounted “2016 Ready: Disaster Resilience Forum – The Role of Microinsurance in Building Disaster-Resilient Communities” earlier this year to help Filipinos prepare for impending calamities and has since cascaded the learnings from the event to the rest of the Philippines through road shows in key cities across the country such as Baguio, Cebu and Davao.

During the road shows, Insurance Commission Microinsurance Division representatives Wilma Conde and Shayne Rose Bulos discussed the benefits of having insurance, especially in the Philippines, a country hit by numerous and varied calamities every year. Meanwhile, Jonathan Batangan, General Manager of Cebuana Lhuillier Insurance Solutions, presented the work that they at CLIS are doing to offer financial security to Filipinos. In 2015 alone, Cebuana Lhuillier insured 6 million Filipinos with the Alagang Cebuana Plus. With the recent introduction of the ACP Gold, the company hopes to provide more financial assistance to those in need, especially in times of crisis.

“I’m proud to say that we at Cebuana Lhuillier are putting in all the work that we can to help as many Filipinos as possible, especially those who belong to the most vulnerable sectors of the society. The launch of the ACP Gold marks another milestone in our journey towards financial inclusion and this is just one of the many meaningful projects that we have. We started the year with the Disaster Resilience Forum, followed by the road show and we still have more to offer in the coming months. In June, we will mount the Nationwide Pilipino Protektado Day where we will provide free insurance covers. Cebuana Lhuillier Insurance Solutions will also spearhead the creation of the Microinsurance Agents Association of the Philippines, Inc., an association of microinsurance individual intermediaries that will work towards the promotion of inclusive and responsible insurance. We intend to also launch the Alisto app which will further help people prepare for disasters,” said Mr. Batangan.

Cebuana Lhuillier has long been helping Filipinos uplift their lives through its innovative microfinancial services and CSR programs on education and sports development for the youth.

CEBU:

DAVAO: