To be financially stable is everyone’s goal, and the key to achieving financial stability is proper management. The earlier you start, the better. Following are 7 apps that can help you – especially if you are a finance management newbie – achieve financial success:

1.Wallet (Android, iOS, Web)

image source: www.macworld.co.uk

Wallet is an expense-tracking app that’s available for both Android and iOS platforms. The app creates records that help you track your expenses, monitor your budget, and check on your financial status. What’s great is that this app can be synchronized with your other devices, and online accounts—really making it easy for you to manage your finances. It even handles your bills and debts—so you won’t forget paying for them!

2.Mint Budgeting (Android, iOS)

image source: play.google.com

What’s great about the Mint Budgeting app is that you can have it connected to your own bank account and it will automatically help you create a budget that’s suited to your lifestyle. This way, you won’t be making unnecessary purchases, and you won’t fall into a pool of debt. You can also be sure that your account would be encrypted and secure.

3.Spendbook (iOS)

image source: appsygadgets.com

As the name suggests, this app is all about keeping track of your expenses. It’s so easy to navigate so you can easily add new expense items, and keep track of your income just to check if you have been spending beyond your means. You could also add your photo, together with a picture or receipt of the item that you have purchased. You can also label your expenses (i.e., subway ticket, cab fare, onion bagel, etc.) so you’ll have a better idea of where all of your money goes.

4.Pocketguard (Android, iOS, Web)

image source: www.appannie.com

Pocketguard allows you to see your current account balance, and all your transactions—whether they’re withdrawals, or purchases that you have paid directly through your account. Thus, you have better control of your expenses—with just a touch of a finger!

5.Home Budget with Sync (Android, iOS)

image source: www.anishu.com

If you’re a finance management newbie, chances are you’re still living with your family or with some friends from college, or even your fellow employees. Thus, you have to make sure that your home budget is in the right place—or else, all of you might fall into a big pool of debt. Home budget helps you sync income and expenses—together with those of your housemates—so you can find ways on how you can save up, and pinpoint what you should stop buying.

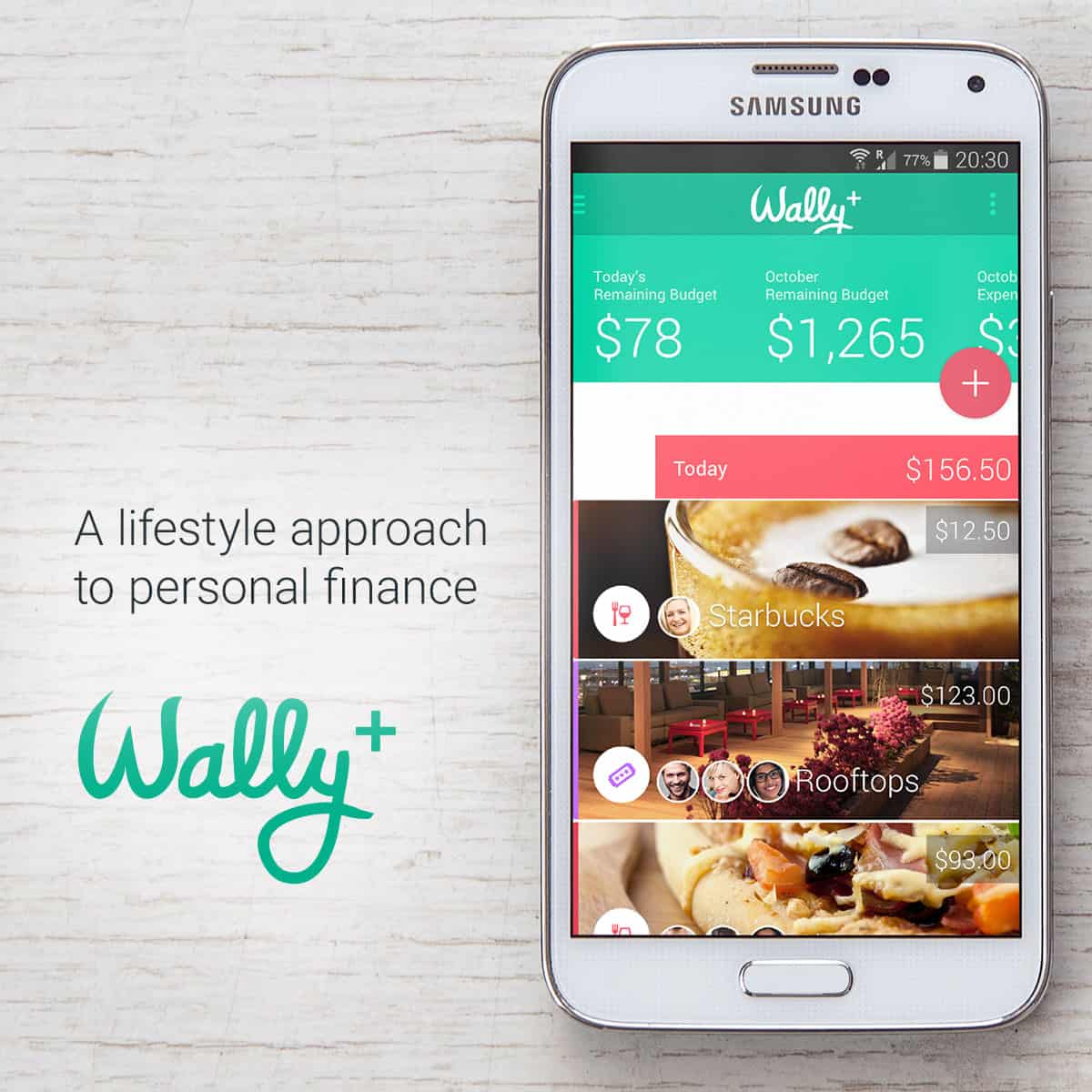

6.Wally (Android, iOS)

image source: wally.me

Sometimes, you have to get back to basics and just set a financial goal for yourself—and Wally would help you do that! With this app, you can make a list of your targeted spending budget, savings, and financial goal for the month, or even the entire year. You’ll also get to see your expenses—so you can check where you’re failing, and what you have to do to reach your financial goals.

7.Level Money (Android, iOS)

image source: www.pastemagazine.com

And finally, you have Level Money. This app connects to your bank and credit card accounts, checks your balances, and tells you how much you can afford to spend on a daily basis—so you won’t go over your set budget.

Work hard—but don’t let what you’ve earned go to waste. With the help of these apps, you’ll surely be in a good place!