These days, it is so easy to overspend, since credit cards are so readily available, and the convenience of online shopping encourages impulse buying. Thus, more and more people are living beyond their means and getting deeper into debt. Fortunately, with a little discipline, there are ways that you can get your finances under control.

1. Track your expenses.

Image source: http://themoneypincher.com/

In order for you to better understand where your money is going so you can control your spending, you should track your expenses. For at least the next week, or ideally a month, write down everything you’re spending. This inventory should include fixed expenses such as mortgage payments and rent, variable expenses such as food, entertainment and gas, and miscellaneous expenses like birthday gifts and car maintenance.

2. Create a budget.

Image source: www.couponsaregreat.net

Budgeting allows you to better control your spending by determining in advance how you will allocate your expenses. Depending on your requirements, you can make a detailed budget that covers all your expenses or a simpler one that includes only those problematic expense categories that you want to control.

3. Allocate your income using the envelope system.

Image source: http://stuffgradslike.com

This is a super-simple way to keep your spending under control. All you have to do is get a number of envelopes that you will label with a particular expense category, i.e. food, entertainment, and so on. When you get paid, draw all your money for the particular pay period from the ATM. Then put the amount that you intend to spend on a particular expense in the proper envelope. Once the money in the envelope is depleted, you can no longer spend on that particular expense until you can replenish it in the following pay period.

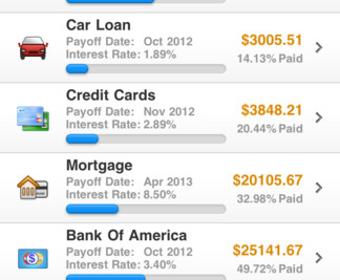

4. Create a debt payment plan.

Image source: http://appcrawlr.com

If you have balances on a number of credit cards, you should make a plan to pay them off. There are two ways you can do this: pay off the card with the highest interest rate first, then the one with the second highest and so on, or pay off the card with the lowest balance first, then the second lowest and so on, until you have paid off all your balances. When you eliminate a balance, use the money you would have spent for it towards paying off the other cards.

5. Look for ways you can reduce unnecessary expenses.

Image source: http://www.wikihow.com

For example, instead of buying premium coffee at a coffee shop, brew your own coffee at home and take it with you in a travel mug. Brown bag your lunch instead of buying it from outside. Reduce the number of times you eat out in a month. Cancel subscriptions to products and services, such as magazines, that you are not really using.

6. Treat your savings as a bill.

Image source: http://twocents.lifehacker.com

To ensure that you are prioritizing savings, you should treat it as if it were a fixed expense, like your rent or your mortgage payments. When you’re paying off these expenses, also make sure to deposit the amount of money you’re allocating for savings into your bank account.

7. Establish a spending limit.

Image source: http://blog.wallstreetsurvivor.com

One of the simplest ways you can control your spending is to set a maximum amount that you will spend for the month or the fortnight, and then only transfer that amount into your checking account from your savings account. This makes it easier for you to control spending since you’ll know exactly how much is available to you.

Finally, make sure that you stick with whatever method you choose. Of course, controlling your finances will not be easy, but with time, effort and patience, you can do it!