Are you prepared? Are you ready to save your life and those of your loved ones? These are important questions that beg serious answers.

Risks and dangers are part of our daily existence. We live in a country that is ravaged by numerous typhoons and earthquakes. Flooding, landslides, and other natural disasters bring untold damage to millions of lives almost every year.

Aside from natural calamities, we also need to be aware of the threat of fire. A large fire at home could wipe out all of your earthly possessions, turning all you’ve worked hard for into a heap of ash. A car accident could also wreck your car and mortally threaten your life and limb. Worse, a sudden illness could wreak havoc in your family budget with the exorbitant cost of medicines and hospital care. However, there is no need to fret nor lose hope because of the many ways we can protect ourselves and prepare for these risks. One of the most effective tools available to protect us and our loved ones is called Micro-Insurance.

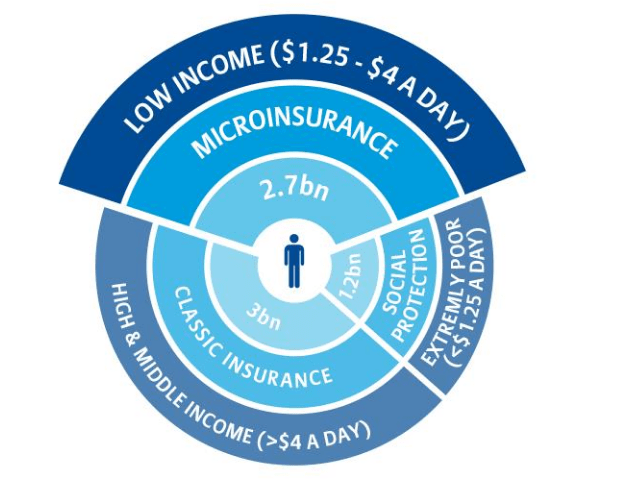

Micro-Insurance is a financial product that aims to protect those with low income against specific risks in exchange for low premium payments. The premium is proportional to the costs and the likelihood of risks to occur. In simple terms, micro-insurance enables a person to have access to financial support should they suffer from natural or man-made disasters or accidents.

Indeed, micro-insurance can literally save your life because of these outstanding features:

Super Low Premium, High Benefits. Some products such as those offered by leading remittance company Cebuana Lhuillier offer micro-insurance for as low as Php 40. Even with such a low premium, the cash benefits can range from Php 5,000 to as high as Php 20,000 depending on the insurance type and premium coverage.

Custom Products to Suit Your Needs. There are many micro-insurance products designed to meet the specific needs of its policy holders. A daily wage earner working in the city has insurance needs that are different from that of a hardworking farmer in the province. The good thing is that companies like Cebuana Lhuillier have many micro-insurance products that are custom-made for workers, farmers, and even security guards and senior citizens.

Accessible All Over the Country. With over 2,000 branches all over the country, Cebuana Lhuillier’s micro-insurance is truly accessible to people from all walks of life.

Easy & Fast Processing. The best part about micro-insurance with Cebuana Lhuillier is the fast and easy processing of applications and claims. It only takes filling out a form to get insured. Get your cash benefits within 24 hours upon filing a claim.

Despite the many risks people face daily, one can still live in peace provided that adequate prevention, protection and care is taken every step of the way. Through appropriate, affordable, yet highly beneficial micro-insurance, you can truly save your life and those whom you value most.