The inevitable day when one passes away is a reality to all humans. However, minimum wage earners are the most at risk when facing natural calamities, such as typhoons, earthquakes, etc. They also put themselves at risk daily with incidents of crime and road accidents.

Whether man-made or brought about by nature, these risks and threats need to be managed or prepared for by wage earners not just physically and emotionally, but also through financial means. Financial preparation is, however, another tough challenge for most working people. Whatever risk one faces, it is important for everyone, especially minimum wage earners to be prepared, especially financially. But since money is tight for minimum wage earners, it is a challenge to be financially prepared for risks and crises.

Imagine being a minimum wage earner with a take home pay ranging from Php 264 to Php 491 per day, depending on the nature of work and location. With this amount, a typical earner prioritizes for his and his families’ basic needs – food, shelter, and school expenses for the children. More often than not, they end up with little or no extra income to set aside for insurance. This makes the impact greater when unforeseen incidents such as illness, accidents or death happen, greater not just for the earner but for his beneficiaries as well. With the prevalence of “5-6” loans, those in need of immediate financial aid resort to these financial schemes which later push them to long-term debt. Requesting aid from employers in the form of salary deductions is also an option they mostly choose. But similar to 5-6 loans, this is not something that would help them in the long run.

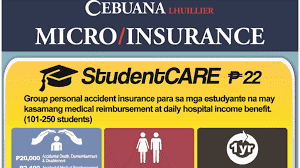

Knowing this, the country’s top pawnshop and remittance company Cebuana Lhuillier developed a micro-insurance product that is simple, affordable, and accessible to every minimum wage earner. The term micro-insurance, in essence, is about providing benefits to people who need financial assistance in exchange for low-rate premiums. For as low as Php 40 or the same value of a mid-priced, kilo of rice, an individual can receive cash benefits as high as Php 20,000 for accidental death or dismemberment, Php 5,000 fire cash assistance, and Php 5,000 micro-life insurance.

Cebuana Lhuillier made sure that appropriate risk protection plans for low-income individuals and members of the informal sector are made available as a way for them to financially prepare for the risks they face daily. With micro-insurance, everyone, especially minimum wage earners in need of financial assistance already has a viable option and a sure financial aid. Micro-insurance products like Cebuana Lhuillier’s Alagang Cebuana Plus Gold can help minimum wage earners rebuild their lives after a sudden loss, sickness, or accident.

With more than 2,000 branches nationwide, a wage earner can simply walk into any Cebuana Lhuillier shop and fill-out the forms. Claims processing only takes 24 hours and requirements are also very easy to comply with.

Indeed, through micro-Insurance, minimum wage earners are assured that they and their loved ones are protected.