Tracking your spending on a regular basis is tough. There might be a situation in which you have a lot of expenditures and bills to pay off, hence, you aren’t keeping tabs on your budget at all, so as long as you’re able to settle all bills and debts. For that matter, you may have an even tougher time tracking your expenses this holiday season, due to the fact that, while it may be a season of being jolly and generous, it is also a season where expenditures are multiplied tenfold. You may have settled your bills as of late, but other expenses such as gifts, the materials used to wrap them with, your company Christmas party contributions, the food for the Noche Buena, etc. are all added variables that may balloon your planned budget for the month. And these added variables are not what you regularly have at your budget list, or at least not the most common thing you’d list down for your monthly expenses. In such case, you’d need a lot of help and valuable tips for tracking your expenditures this Yuletide season. Look no further than our important budgeting lists:

1.) Plan everything out beforehand.

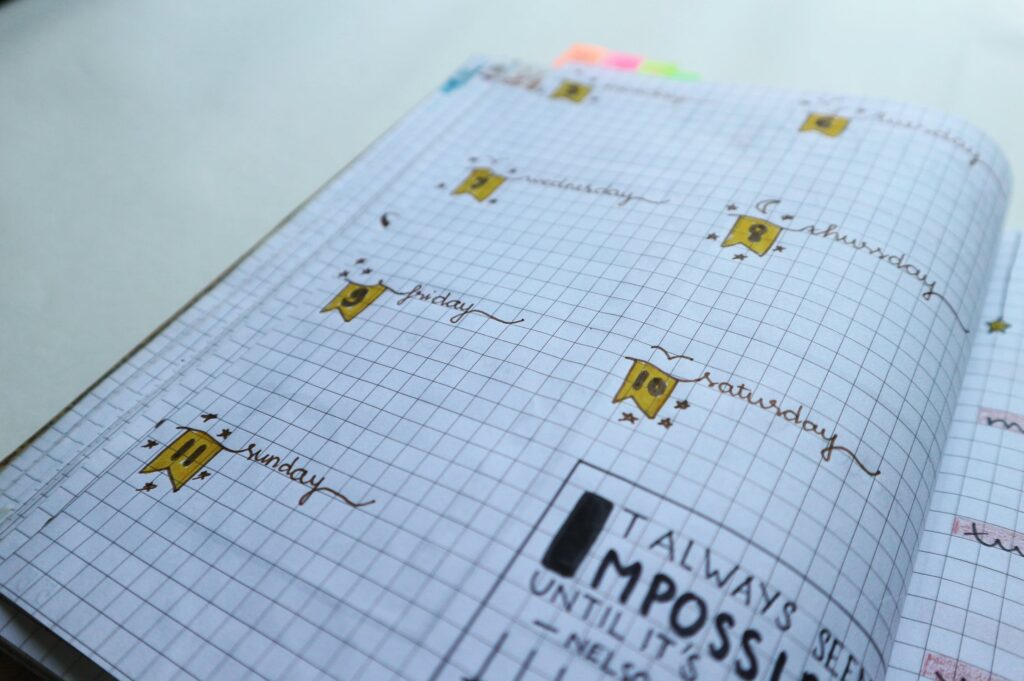

Those who are prepared to face every obstacle or adversary always has a bigger chance of winning in the end. The same goes for tracking your expenses. What better way to do that efficiently than to have a master plan of your expenses, even before the holiday season begins. Consider plotting out the things you’d need to buy for the holidays, like gifts, the gift wrappers (yes, regardless if they cost a little less than a hundred, that is still an expense), food, replacement Christmas decorations, etc. After listing them down, combine them with the other things you’d normally write down in your monthly expense list. Of course, utility bills are still a priority. You wouldn’t want to spend Christmas Eve with no lights or connection at all. After that, you may go into detail, with regards to who are the people you are gifting this year. Be sure to list them down clearly, so you wouldn’t lose count and forget someone. And then, feel free to write down the food as well. It’s fine if you were to list down the deliverables for the Noche Buena at first, but never forget that you also have guests in the other days of the Yuletide season, which is why you should at least consider setting aside a few more amounts for your simpler “menu” for guests.

2.) Expenses are always easier to track if there are only a few in your lists.

If you think writing down your expenses is the hardest thing about tracking your financials this holiday season, think again. Eliminating items from your list is tougher. To put that into perspective, you are listing down things to purchase (gifts, food, clothes, decorations, etc.), and then having to choose which one of those you’d erase after. We are not saying that you’d erase the whole category in one go, what we mean is you’d have to choose a few of the things from the “sub-category.” For example, within the main category of food for this holiday season, not all of the food you have in mind would have to be prepared, or at least not the whole menu you had planned in advance. If you have too many sweets, then you may favor one dessert over the other. The same goes for Christmas decorations. Do you really need a new Christmas light? If the one you’ve used the year before still works, then scratch Christmas lights off your list, and focus on buying other holiday decors. Again, eliminating something from your list doesn’t necessarily mean erasing the whole thing, but at least reducing the amount or volume of that expense category. As we’ve said, it’s easier to track your expenditures without too much clutter on your budget list. With that in mind.

3.) Not everyone has to receive gifts this holiday season.

We do not mean to sound like the Grinch, but that is a most truthful statement right there. If you want to track your expenses in an efficient way, at least limit your gifting list to family and friends. You may eliminate workmates from the mix, since you’ve already contributed to the Christmas party, may it be financials or with exchange gifts. You may also want to eliminate your best friend’s cousin, your neighbors, and even your Barangay chairman. In short, focus on people who are the closest to you. This is efficient, in a way that you are very familiar with the people that matters most, you know what they like and what they don’t, you know the type of gifts that they would commend you for, you know where and when to buy these gifts. And having that much familiarity is the key to tracking and even predicting how much your gift expenses would be. You may get creative, go big, or even go small, so as long as you know, whatever you’re giving these important people in your life would be very much worth it. Of course, tracking your expenses isn’t far from reducing them. After all, isn’t that the purpose of you managing an expense list? So that you may monitor whether you’re going over your planned budget or not. You’ll always need to save and set aside a few amounts for future expenses.

With all of these in mind, you may be looking for a well-trusted name that would safely value the security of your savings during the holidays.

Well, look no further than Cebuana Lhuillier’s Micro Savings, at its core, it aims to provide easier banking access to Filipinos. The product is almost the same with any regular savings account in the Philippines, but doesn’t require a maintaining balance. You will only need 1 government ID and atleast P50 initial deposit, Filipino citizens as young as 7 years old old are also qualified to open an account, which can be considered as a “kids savings” or “junior savings” account. So what are you waiting for? Feel free to visit the nearest Cebuana Lhuillier now!