Congratulations, you are now earning your own money! BUT, before you rush to spend it on all your heart’s desires, think about where you want your hard-earned money to go.

There are far too many sad stories of Pinoys giving in to their impulses that they end up with nothing after all their hard work. While it is okay to treat yourself every now and then (it is your own money, after all), it is always best to save some of it. Here are the steps that will help you start building your wealth, even as a first time employee:

Step 1: Determine the exact amount that you are earning

image source: drupal.in-cdn.net

For instance, a 10,000 to 15,000-peso monthly compensation might look amazing, but in truth, there will be several deductions, including taxes, Pag-Ibig, SSS, and Philhealth. Your net income is what is left for your saving and spending power.

Step 2: Decide how to divide your money and where you want each allocation to go

image source: filentrep.com

Even after the deductions, you might still think your net income looks substantial enough to let you afford a postpaid cellphone plan, but the truth is that there are more expenses to worry about.

First, calculate your basic monthly living expenses (rent, utility bills, transportation costs, food expenses) and deduct that from your net income. The remaining amount is your residual income and it is what you have left for savings and for your wants. The amount of each category depends on you.

Step 3: Pay off all of your debts first

image source: moneytipstricks.com

If you have any debts, such as student loans, credit card bills, or money you owe to people from whom you borrowed when you were still unemployed, you need to pay them off ASAP, especially when there is interest involved. Aim to channel 80 percent of your residual income on paying off debts.

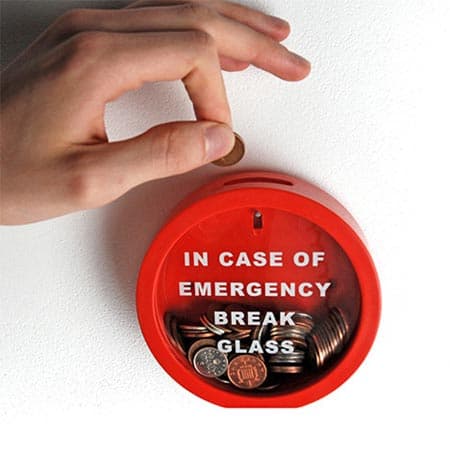

Step 4: Build an emergency fund

image source: millionaireacts.com

Once your money is out of the red (meaning “wala nang utang”), you can start building an emergency fund in a bank account. An emergency fund is the money you will use only when you lose your job or when you need to pay for medical expenses not covered by your company’s insurance.

It is recommended that you do not use a savings account with ATM access because the temptation to withdraw will be too strong. Look for small-time but reliable savings banks that offer passbook accounts with a lower maintaining balance, such as City Savings Bank or BPI family Bank.

Step 5: Consider life insurance

image source: youngpinoymillionaire.com

Life insurance is essential for those who have dependents, because if something happens to you, the company will provide a premium amount to support your family. Make sure to find an insurance agent from a company you can trust. Take note that life insurance is not a savings account for your retirement.

Step 6: Open an investment fund

image source: media2.intoday.in

Savings accounts in banks will not let your money grow substantially; in fact, you may end up losing money because the interest you gain is not enough to catch up with inflation. As soon as you have reached your emergency fund goal, you should start putting money into an investment vehicle. Have your risk tolerance assessed by an insurance agent and then research on the fund that he or she will recommend to you.

Follow these tips and you will not be sorry when the time of your retirement comes, or when an emergency strikes. Good luck!