Vehicle insurance – everyone needs them. Whenever you’re riding down the road, you are certain that anything can happen, and indeed, many unexpected things do occur on the on a daily basis. Even the most seasoned drivers, riders, and even commuters are faced with unforeseen circumstances, so much that many would prefer to prepare for the inevitable. The good news is, there is such a thing as a vehicle insurance, a form of protection for when the unexpected were to happen. Now, you may ask, what is vehicle insurance? Simply put, vehicle insurance is defined as:

“The insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.”

So the next time you’re on the road, you no longer need to fear about big expenses due to collisions, as you can pretty much be sure that an insurance will cover all the expenses for you. Now, in spite of the fact that the definition seems a bit generalized, there are actually multiple types of vehicle insurances. We wouldn’t like to lull you to sleep, so, we will only be discussing one major vehicle insurance that may very well catch your interest.

What is a CTPL insurance?

The abbreviation CTPL stands for Compulsory Third Party Liability (CTPL). Within the insurance industry, it is also known as Compulsory Motor Vehicle Liability insurance or CMVL. Before we proceed any further, take note that the CTPL coverage is mandated by the Land Transportation Office (LTO) of the Philippines for all motor vehicle owners. This means that it is at least one of the preliminary requirements that you must acquire before even heading out to LTO to register your newly bought vehicle. With that in mind, let us proceed with its main purpose, which is, “to protect the owner of the vehicle from financial obligations to anyone who is injured or killed by the insured vehicle.” Keep in mind that all of this applies to owners of both cars and motorcycles, so whether you’re riding a delivery van or scooting through on two wheels, you are required and entitled to own such insurance.

Now, the definition and the purpose itself may sound simple, however, there are a few technicalities when it comes to the implementation of the CTPL insurance. To be clear about these technicalities, here are just a few of the major ones. Keep these in mind for when you are about to acquire this particular insurance in the foreseeable future to avoid any confusion.

- The CTPL only covers third parties, and that does not include the driver.

You may ask, “Who are these third parties?” How would I determine which is which? Well, third party members may refer to any unsuspecting person outside the vehicle and is not a member of your family, including household members. For example, if (by accident) you were to hit an innocent bystander or a pedestrian, your insurance will pay for the expenses of that injured person. However, if you accidentally hit your maid or your brother, your CTPL will not cover their medical expenses. It’s a bit tricky to understand at first, but always remind yourself that the insurance mostly caters to “strangers,” rather than your “relatives and loved ones.” Doing so would make it easier to comprehend.

- The CTPL also has benchmark for whom to provide compensation for, if they are within the vehicle.

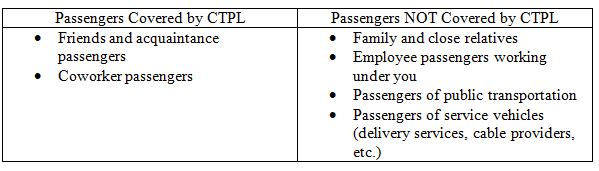

Of course, CTPL doesn’t just cover bystanders getting hit and injured outside the vehicle, it also covers the expenses of the passengers within the vehicle itself, though this may get too technical, so we will segregate them through a simple chart:

Now, we understand that a CTPL may not seem too inclusive at first, but it is only because it is a different type of insurance, which people may misinterpret for other comprehensive personal insurances. A general consensus even clarifies this:

“A CTPL is NOT a comprehensive car insurance, and it isn’t a substitute for what that insurance offers as well. A comprehensive car insurance offers more coverage than a CTPL, in terms of loss and/or damage of vehicle, excess bodily injury, property damage, no-fault indemnity cover, and auto passenger personal accident.”

This means that a CTPL is more of a complimentary insurance to a comprehensive vehicle insurance rather than being a standalone. This may seem too much of a process (not to mention, financial expense) from a glimpse, but there is a good news to this.

- The CTPL insurance is affordable, more affordable than the expenses that you may acquire just by being involved in a road accident without having bought any coverage at all.

We might have mentioned this before in one of our older write-ups, but the one-year coverage of CTPL usually entails a PhP560.00 fee for private cars and PhP250.00 for motorcycles. If you opt for a three-year coverage, private cars can pay PhP1,610.00 and for motorcycles PhP720.00. As you can see, it isn’t really much of a hassle when it comes to the budget. Just imagine the thousands you’d have to spend if you were not able to purchase a reliable CTPL insurance.

Okay, so is there anywhere in the Philippines where I may acquire this CTPL insurance?

Yes, as a matter of fact, the nearest source may just be one tricycle ride away from you. Cebuana Lhuillier offers their very own CTPL insurance. Don’t let the name fool you, for many years, Cebuana Lhuillier has branched out towards other services such as microinsurance and microloans. And within those years, they have proven that they can deliver outstanding service even beyond their main offering, which is pawning.

If I were to avail a CTPL insurance from Cebuana Lhuillier, does it entail any benefit for me?

Yes, it actually does. The great thing about Cebuana Lhuillier is that they offer more than the usual ins and outs of their services, as they also offer various promos that would greatly benefit their patrons. For example, they recently introduced their CTPL E-raffle Promo.

What is Cebuana Lhuillier’s CTPL E-raffle Promo and what are its mechanics?

- This e-raffle promo will run from July 1 to October 31, 2020.

- This is open to all clients of Cebuana Lhuillier.

- For every purchase of CTPL, clients will be entitled to one (1) e-raffle entry and will have a chance to win a brand new motorcycle.

- There will be one (1) winner of Motorcycle per region for a total of eight (8) winners in the grand draw.

- Deadline of entries is on October 31, 2020, 11:59 PM.

- Qualified entries will be electronically drawn on November 4, 2020, 10:00 AM at PJ Lhuillier Inc. ICT Office 3/F, The Networld Hub 156 Jupiter cor., Bel Air, Makati City 1209.

- Winners will be notified through notification letter/SMS.

- Unclaimed prizes will be forfeited sixty (60) days upon receipt of notification.

- Employees of P.J. Lhuillier Group of Companies, agencies and services and their relatives up to second degree of consanguinity or affinity are not qualified to join the e-raffle.

So, what are you waiting for? Have your rides insured or renew your CTPL now at Cebuana Lhuillier! Feel free to visit the branch nearest you. We ensure a fast, easy, and convenient transaction.