Banks – what would we do without them? They’ve been around for centuries, allowing everyone to undergo and process their financial transactions within their preferred branches (given that they have an account, of course). People may choose to apply for a new account, or apply for a bank-sponsored loan, make a deposit, make a withdrawal, and even pay their bills. Indeed, banks are the one-stop spots when it comes to financial transactions. Every process is delicate and is handled by a well-trusted staff of the bank itself, may it be the teller or the bank manager. Nonetheless, one of the main commodity within a bank isn’t even the huge stash of money within the safe, but rather, the trust given by its countless clients. If a majority of people doesn’t trust a particular bank or one of its branch, you can bet that the daily crowd size would decrease within a short amount of time. No one likes to conduct business with an establishment grazed with a bad review, after all.

With all of that in mind, you may probably be wondering, “How do I make sure that the bank I’m dealing with is a “Triple A” choice? What are the traits of a well-trusted bank? How convenient are they than other banks which I’ve already had the pleasure of transacting with before?” All of these may be answered by taking a peek into the work structure of a bank itself, it’s relevance in our community, as well as a short history of how it was made.

A Brief History about Banks

Believe it or not, the first few set of banks weren’t even handling money transactions back then. Around 2000 BC in Assyria, India, and Sumeria, the first prototype banks (which were the merchants of the world), made grain loans to farmers and traders who carried goods between cities. It wasn’t until the reign of the Roman Empire did they adapt and implement what would become the system that we have in our modern banks right now, with lenders based in temples making loans while accepting deposits and performing the change of money.

Another important part of banking history dates all the way back to Italy, citing the crucial development of banking’s business structure during the medieval and Renaissance period. Now that’s the literal meaning of history, right there.

What are the traits of a well-trusted bank?

Each individual deserves to experience an exemplary service from their own choice of bank. It has nothing to do with the economic status of the clients as well (whether they deposit a big amount or not), as it is up to the bank and its staff to make each and every person feel that they are the kings and queens of the hour. It will always be the bank and its underlying staff’s responsibility to uphold the good reputation and trust given to them by their clients. With that being said, here are a few vital indicators that the bank you’re transacting with may be deemed exemplary and trustworthy:

1) Transparency – Whether a client’s loan application would come with an interest rate or not, it should be mentioned first hand, before any contract or agreement were to be signed. Of course, the bank representatives do not necessarily need to divulge all of the bank secrets to the client, but rather, the underlying fees involved in each transaction, including interest rates and other possible service charges. Some clients are willing to pay up these said fees anyway out of goodwill towards the bank, hence, why hiding any detail from them would be counter intuitive at best. Speaking of fees..

2) No Unnecessary Fees – It’s normal for any establishment to charge service fees in order to keep the ecosystem of their business running. However, this shouldn’t be abused to the extent that the client would need to shell out hundreds if not thousands of Pesos just for a single transaction. A trustworthy bank would always have the client’s goodwill in mind, which is why they should avoid overcharging them at all cost. Aside from that, the mere act of withdrawing and depositing money shouldn’t have any additional fees with them, unless of course a client were to withdraw money from one of the bank’s ATMs using a debit/cash card from another bank (inter-banking charges will always apply in this case).

3) Exemplary Service – Bank representatives should be active in helping out their clients with their various banking needs. A bank is considered exemplary if it has a good reputation that would precede it. Good services would always translate into short lines, quick flow and process of transactions, and good reviews from the clients themselves.

All of these may signify that your typical bank would definitely be the best place for you to trust your money with. But what if we were to tell you that there is a much better alternative to this? What if we were to tell you that such alternative is purely unique, unorthodox, and very trustworthy? Well, look no further than your local pawnshop.

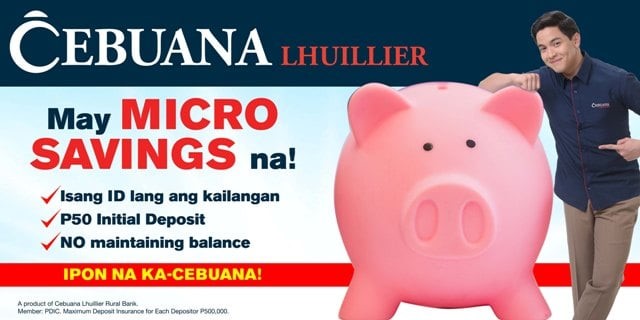

“A Pawnshop?” You may ask. Yes, you’ve read that right, a pawnshop that also functions as a bank. Believe it or not, such an establishment exists, and it is none other than a longstanding name that you can trust, Cebuana Lhuiller, or more specifically, Cebuana Lhuiller’s Micro Savings Account.

Initially offered in their Rural Bank branches, it is now available through their entire Cebuana Lhuillier branch networks. But that’s not all, as there are still other advantages in signing up for Cebuana Lhuiller’s Micro Savings Account:

1) You will be able to use your 24K Plus and 4C Cards at any of the 2,500 Cebuana Lhuillier Pawnshop and Cebuana Lhuillier Rural Bank branches in order to withdraw or deposit on your savings. with 2,500 branches nationwide.

2) With a minimum deposit amount of only P50 and no minimum maintaining balance, it’s incredibly easy to apply for one. Other banks have a higher required amount when it comes to the initial deposit, going as high as P1,000 – P2,000. And we’ve only mentioned the deposit amount, as there may be other fees involved if you decide to open an account in your typical bank. Cebuana Lhuillier Micro Savings account would not require you to do that at all. Aside from submitting a few paper works and documents for the processing of your account, you’ll be good to go in no time. How is that for unparalleled convenience?

3) It is now much easier to check your balance without even breaking a sweat. Remember when we said that one of the main characteristics of an exemplary bank is their smooth work flow and short lines? Well, Cebuana Lhuiller’s Micro Savings account beats that by a mile, by not even requiring your physical presence in order to check on your account balance. Instead, you may accomplish that via their SMS service, a much reliable way, ready to serve you 24/7.

So, what are you waiting for? Visit your nearest Cebuana Lhuillier branch now for more details.