All of us should learn to save, come rain, come shine. There used to be a time when we’d laugh and take that quote for granted, but now that we’re in the middle of a pandemic, that passage has never been more true. A person’s motivation to save is purely out of his/her necessity to prepare for any unforeseen crisis, and when that crisis finally arrives, that very same person can at least breathe a sigh of relief, knowing that they can go toe to toe with any financial problem that comes their way. As the head of your family, it is your responsibility to teach your loved ones the value of money. Every centavo counts, no amount, no matter how big or small, should be wasted or spent unceremoniously. It is the responsibility of every family member to do their part, to save every peso or centavo that comes their way.

Now, you may ask, “How would I teach my family to save?” It sounds so simple, yet tricky to accomplish. One minute you’re telling your kids to conserve water and electricity, the next you’re scolding them for not following your instructions. Indeed, something so simple may turn out to be too difficult in the long run. But here’s the thing, nothing in life is ever easy. Forget about the thought of being able to save because it’s the easiest thing that you’d ever have to do. No, being able to set a significant amount for your future and the future of your family would never be an easy task. So in lieu of that, we’ve prepared a few pointers to help you with this. It may be a long process from here on out, but at least you’ll be on your way towards financial progress.

- Reminders never hurt when trying to discipline your family to do the right thing.

Let your family know that you are serious about saving. Whenever you’d feel that they’re about to spend more than what they’d need, remind them. Don’t call them out like a principal calling out a naughty student, but instead, talk to them. Talk to your youngest kids, talk to your eldest children, talk to your spouse about the amount that you’d be able to save for the week. Give them a general idea of the dos and don’ts, remind them that even though it’s difficult at first, all would benefit from being able to save, even for the whole month. Savings, no matter how small they are can contribute towards the improvement of your financials. Remind them that not all the nice things can be bought, and should be bought. Let them know that everything should be accounted for, may it be money or other forms of resources.

- Set a good example at home.

As the head of your family, no one else would be a better example than you. All of it, the initiation, the motivation, the pep talks, all of it has to start from you. And rightfully so, you should set in stone that you are doing your part to manage the budget, you are doing your part to save, so you should expect your loved ones to do the same. Of course, this doesn’t mean that you should hold your money all too tight, as understandably, the household is standing on its feet due to the budget. Whatever it is that they need, food, water, electricity, take that into account and spend your earnings on those needs, but avoid overspending on the other non-essentials. After paying for the essentials, set aside the leftover amount and show your loved ones that not one centavo is wasted. Be firm about your saving, continue to be a great example, then watch them follow your example.

- Set their expectations. Let them know of the advantages of saving.

Of course, there is always a purpose to your current actions. You are not managing your budget well right now just because you’re paranoid of the future. No, it’s all about being prepared, being ready for any unforeseen circumstances. Take the current pandemic, for example, no one knew that such a virus would cause too much damage on our economy, let alone, across the world. Many were unprepared when COVID-19 hit our shores, no one knew its effects to the human body, and that such a virus may cause huge expenses due to the severity of its symptoms. To say the least, people who’ve been preparing even before the pandemic started would have a cushion in their budget. So if ever (knock on wood) one of their loved ones were to be infected, they wouldn’t need to worry too much about the expenses. The same principle would apply to the people who lost their jobs due to the virus, many companies closed down, many were let go, many were given no choice but to try to find a new job, and that task is almost close to impossible, due to the fact that the pandemic brought with it a scarcity of jobs across the country. People who save, people who are able to set aside a few thousands in their account may be able to provide for their families, even well beyond a time of crisis.

Of course, advantages towards saving may come in many different forms. While the normal advantage would come out as an emergency fund for the unforeseeable future, one surprise advantage would be one which is currently implemented by Cebuana Lhuillier. Introducing, Cebuana Lhuillier’s Instant Savings Promo 2020!

What is Cebuana Lhuillier’s Instant Savings Promo 2020 and what are the Promo Mechanics?

Cebuana Lhuillier’s Instant Savings Promo 2020 is a raffle promo implemented within Cebuana Lhuillier’s Microsavings service. The promo mechanics are as follows:

- The promo period is from June 15 to September 14, 2020.

- New and existing Microsavings account holders are eligible to join the promo.

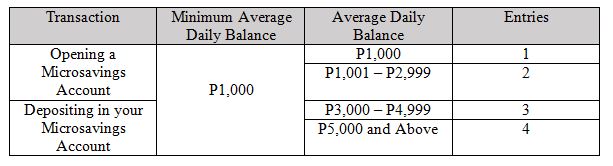

- Participants would be able to obtain an e-raffle entry by doing the following transactions and maintaining at least a minimum of P1,000 Average Daily Balance (ADB) within 30/31 days:

These details are just the icing on the cake, as we know that you’re curious to know more about the complete mechanics. In such case, you may visit https://www.cebuanalhuillier.com/instant-savings-promo/ for more information.

With all of these in mind, you may be looking for a well-trusted name that would safely value the security of your hard-earned money and savings during the pandemic. Well, look no further than Cebuana Lhuillier’s Micro Savings services. At its core, it aims to provide easier banking access to Filipinos. The product is almost the same with any regular savings account in the Philippines, but doesn’t require a maintaining balance. So what are you waiting for? Feel free to visit the nearest Cebuana Lhuillier now!