A Microsavings account – an affordable and accessible option than your average bank account. You may be wondering why this is the case, well, let us elaborate further on that. Microsavings accounts are basically accounts which consist of a small deposit account offered to lower-income families or individuals as an incentive to store funds for future use. Microsavings accounts are somehow similar to a normal savings account, however, they are tailor-fitted for smaller amounts of money. The minimum balance requirements are often waived or very low, allowing users to save small amounts of money and not be charged for the service. In such case, we can say that a majority of the Filipinos would be able to afford this, but let us clarify on that. As accessible and affordable as it may be, a majority of Filipinos aren’t really familiar with the concept of a Microsavings account yet. Many Filipinos are not informed about this fantastic alternative to a mainstream bank’s services, owing to the fact that well-known banks would spend countless amounts in marketing and ads just to flood out any news of this more affordable option. With that in mind, allow us to orient you about the features of a Microsavings account, the basic ins and outs, and the requirements in acquiring one.

How different is a Microsavings account from a normal bank account?

Purpose, that’s what differentiates a Microsavings account from the usual savings account. Let us put this into perspective:

A normal savings account has no limits. You can deposit any amount of cash, and at the same time, you can also withdraw any amount of money. You may do so as you please. If you were to deposit around 1 million Pesos, you can withdraw that 1 million Pesos the very next day. Indeed, it’s limitless, but that lack of limitation would make it conducive to abuse. Think about it, you can deposit and withdraw any amount, with no discipline in mind. A Microsavings account, on the other hand, has its own definite pro, in that it aims to end the stigma and proceed to discipline people about their spending habits. It would limit people who has the tendency to consume and spend more than they can save. It also aims to be more inclusive, being flexible and accessible by our fellows who are not fortunate enough to have the complete requirements needed in opening their own savings account in a bank.

A financial expert even gave his two cents when it came to the disadvantage of having a savings account: “The terms of traditional savings accounts may limit the ability of individuals with small funds to open such accounts, particularly if they do not have the minimum amount to get started. The stipulations of traditional savings might make the benefits of starting such an account limited or nonexistent for someone with a small amount to get started as well. For instance, a traditional savings account might incur regular fees if a minimum balance is not maintained. Furthermore, the account might generate negligible interest if the balance does not meet a certain threshold. The process of opening a traditional savings account could also prove to be intimidating to individuals who have little to no experience with banking institutions.”

So you can just imagine the struggle of people who are hoping to save up for their future, only to be stopped by the technicalities of opening a savings account in the first place, that technicality being the cost of opening the account itself.

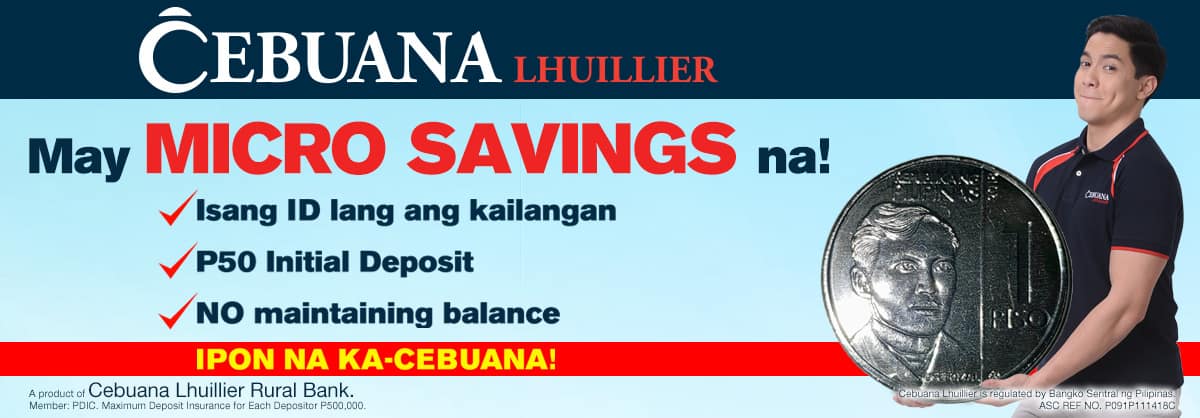

Now that we know of their main difference, we may proceed with the advantages of choosing to open a Microsavings account over the typical savings account. For the purpose of clarity, we will be using Cebuana Lhuillier’s Microsavings service as an example. They are easily one of the best options when opening a Microsavings account. They also offer one of the most comprehensive Microsavings account to date.

1. No maintaining balance needed.

A Microsavings account would not require its account holder to maintain any form of balance within the account itself. While a normal bank would at least require you to leave P100 to P200 within your savings account, Cebuana Lhuillier understands the current situation of the Filipino people, wherein, every centavo counts. If Microsavings accounts were to require a maintaining balance, that would result to an extra P100 to P200 decrease from the average Filipino’s budget. That extra P100 to P200 would have been a great addition towards the food and grocery fund, instead of being used as untouchable filler within your savings account.

2. Microsavings accounts have more flexibility and leeway when it comes to their account holders.

A mainstream bank’s typical savings account has many restrictions. For one, the age limit is a bit problematic, not allowing kids to open their own account, until such time that they have reached a legal age. Microsavings accounts are way different than that. Cebuana Lhuillier’s Microsavings account, for example, qualifies children as young as 7 years old to open their own account (with the help of their parents, of course), which can be considered as a “kids savings” or “junior savings” account. Remember when we said that Microsavings accounts are more focused on disciplining its account holders when it comes to financial management? This is where it is most distinguishable, as training your kids to properly manage their finances at an early age has a positive outcome once they grow up into responsible adults.

3. The requirements are easier to accomplish and present.

Cebuana Lhuillier’s Microsavings service is very inclusive, as indicated by their list of requirements. For example, in order for you to apply, you just need to visit any of Cebuana Lhuillier’s 2,500 branches nationwide and fill-out the Client Customer Information File Sheet while presenting the following:

- Government issued ID

- Birth Certificate (applicable to minors only)

- Student ID (applicable only if student is currently enrolled)

- P50 minimum initial deposit

- P100 card fee (for clients w/o 24k card)

Take note of the initial deposit amount. Yes, you’ve read that right, only P50. The list of IDs you may present also makes the application process welcoming in its very own way, as the list of accepted Government/Valid IDs are:

- Passport

- Driver’s License

- Professional Regulation Commission (PRC) ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Voter’s ID

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) ID

- Senior Citizen’s ID

- Overseas Workers Welfare Administration (OWWA) ID

- OFW ID

- Seaman’s Book

- Alien Certification of Registration (ACR)

- Barangay Certificate or ID (with picture and signature)

- Birth Certificate (applicable to minors only)

- Firearm License

- Immigrant Certificate of Registration

- Marriage License

- National Council for the Welfare of Disabled Persons

- New TIN ID

- OWWA ID

- Student ID

- Alien Certification of Registration (ACR) / Immigrant Certificate of Registration

- Government Office or Government Owned and Controlled Corporations (GOCC) ID (e.g. AFP ID, HDMF (Pag-ibig Fund) ID, etc.

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID (IBP)

- Company IDs issued by private entities or institutions registered with or supervised or regulated either by the BSP (Bangko Sentral ng Pilipinas), SEC (Securities and Exchange Commission) or IC (Insurance Commission)

Even owning one or two of these would be enough to qualify you for a Microsavings account.

So, that is basically it. Microsavings accounts are indeed, the future of affordable banking. They have established themselves as the most accessible banking option ever, while still improving their services, offering a lot more in the long run. The features, the options, and the perks are just way too impressive to ignore. So, what are you waiting for? Visit your nearest Cebuana Lhuillier branch now and feel free to inquire about their amazing Microsavings services.